Real Estate Math Formulas and Free Hints to help Real Estate Agents pass the Real Estate Exam

A lot of people are afraid of the real estate math part. Unfortunately, real estate math concepts can be 10% or more of the real estate exam. Many people ignore the real estate math problems and hope that they’ll do well enough on the rest of the exam to pass. That’s certainly possible, but it doesn’t leave much room to miss other questions.

A better way is to master the math questions on the Real Estate Exam using our simple techniques.

This article starts the real estate career with a refresher on basic real estate math skills and some real estate math concepts before covering the skills needed to answer the most common real estate math questions on the Real Estate Exam.

The best part is that one simple formula can be used to answer most of the questions. Once you learn that formula, answering those questions will feel almost automatic.

Basic Math and Word Problems

Before jumping right into actual real estate math calculations, it's important to have a brief refresher on the most commonly used principles of basic math that are found on the real estate examination.

You probably won't see a question on your exam that directly tests your basic math abilities, but you will need to have these topics mastered to solve the questions that you will be asked. That's because most of the real estate math questions you'll see will require several steps to arrive at the solution. At least one of those steps will involve basic math.

There is special terminology used in each of these basic functions that sneaky exam writers love to use to trick you into getting a basic step wrong.

In fact, all that's reviewed in the addition, subtraction, multiplication, and division sections is terminology that will help you with word problems. After all, you won't need to review how to actually do these since you'll be able to use a calculator (check your state's requirements to see which kind you can bring or if they're provided).

Addition

Addend + Addend = Sum

The two (or more) numbers that are added together are called addends. The total, once added, is called the sum.

Addition Word Problem Keywords

These keywords indicate that you might be able to use addition to solve a word problem:

- add

- added

- additional

- all

- all together

- and

- both

- combined

- entire

- exceeds

- gain

- greater

- in addition to

- in all

- increased by

- more

- more than

- plus

- raise

- sum

- together

- total

Subtraction

Minuend – Subtrahend = Difference

The largest number that is subtracted from is called the minuend. The number that is subtracted from the minuend is known minuend is called the subtrahend. The result is known as the difference.

Subtraction Word Problem Keywords

These keywords indicate that you might be able to use subtraction to solve a word problem:

- change

- changed

- compare

- compared to

- decrease

- decreased by

- difference

- fewer

- fewer than

- higher

- how many more

- larger

- left

- less than

- longer

- lost

- minus

- reduced

- remain

- smaller

- subtract

- take away

Multiplication

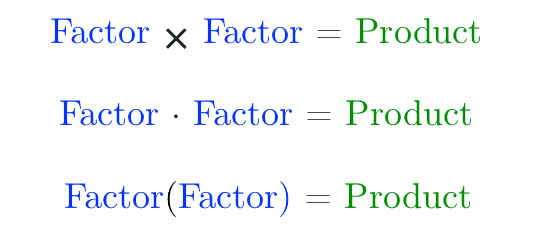

Factor × Factor = Product

The numbers that are being multiplied are called factors. The answer is called the product.

Multiplication can be displayed in the following ways:

This next part is going to sound a bit advanced because mathematicians like to use confusing words, but hang in there.

When dealing with variables (think of solving for the variable x), multiplication can also be expressed by placing a coefficient in front of the variable, which means to multiply the variable by the coefficient.

In simple English pretend that you have a variable that we’ll call x. If we were to write 9x it would mean “9 times x.” See how that works? It’s pretty much the same as the third example above, but without the parenthesis. Getting back to that confusing terminology, the number 9 is the coefficient of the variable x.

Multiplication Word Problem Keywords

These keywords indicate that you might be able to use multiplication to solve a word problem:

- at

- each

- every

- groups of

- multiply

- per

- product

- rate

- sets of

- times

- total

- twice

Division

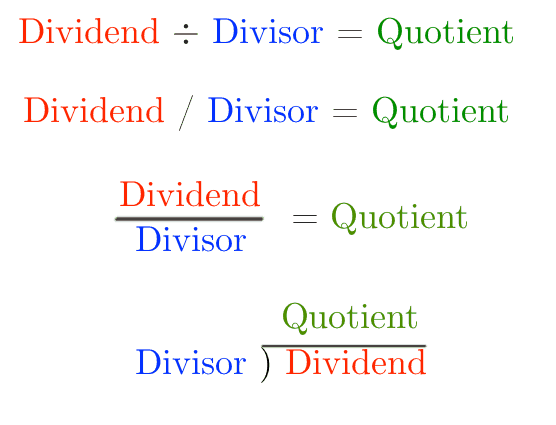

Dividend ÷ Divisor = Quotient

The number that is being divided is called the dividend. The number that you divide by is called the divisor. The answer is called the quotient.

Division can be displayed in the following ways:

Division Word Problem Keywords

These keywords indicate that you might be able to use division to solve a word problem:

- average

- cut

- cut up

- divided

- divisor

- each

- equal parts

- evenly

- every

- half

- out of

- per

- quotient

- separate

- shared

- split

Order of Operations

If you do math problems in the wrong order you’ll get the wrong answer. That’s why there are rules for what to do first.

There’s a funny sounding word that can help us remember the rules. It’s the word PEMDAS. Let that word simmer in your memory as we look at the following problem.

If you need help letting it simmer you can try to remember the sentence Please Excuse My Dear Aunt Sally.

\( 7 - 2 \times 3 = \)

We’ll get two different answers if we solve this problem in a different order. If we started with \( 7 - 2 \) we’d get five and then multiply five times three to get fifteen.

\( 5 \times 3 = 15 \)

However, if we started with \( 2 \times 3 = \) then we’d get six and then subtract six from seven to get one.

\( 7 - 6 = 1 \)

We can both agree that there’s a difference between fifteen and one and they both can’t be the right answer. But one has to be, right?

That’s where PEMDAS comes in. The word PEMDAS helps us to understand the order used to solve a problem. The letters in the word stand for mathematical terms.

- P for Parentheses. If the problem has (parentheses) then solve what’s in them first.

- E for Exponents. If the problem has exponents2 then solve them next.

- M for Multiplication.

- D for Division. Complete all multiplication and division in the problem, working from left to right.

- A for Addition.

- S for Subtraction. Complete all addition and subtraction in the problem, working from left to right.

Multiplication and Division have the same priority so you’d complete all of the Multiplication and Division in the problem from left to right. You wouldn’t do all the Multiplication first and then do the Division.

The same goes for Addition and Subtraction. Complete all Addition and Subtraction from left to right. Don’t do Addition first and then Subtraction.

If you want to get really technical, we can group it this way:

- P

- E

- MD

- AS

But that doesn’t look as nice, right? Just remember that the operations that have opposites are on the same level. Multiplication and Division are opposites and so are Addition and Subtraction.

So how does this help us with the example problem we worked on above? It means that we were supposed to do the multiplication, not the subtraction, first. So that means the second answer (one) is the correct one.

Order of Operations Quiz

\( 5+3 \times 2= \)

- 11

- 16

- 10

- 8

Click for the Answer and Explanation

Answer: 11

Explanation: Using the order of operations we first multiply 3 times 2 to get 6 and then we add the 5 to the product to get 11.

Fractions

A fraction is a part of a whole. When you know this it’s easy to understand what’s meant when you see a fraction. That’s because fractions are written almost exactly like the definition. They are written as a part over a whole.

For example, the fraction \( \frac{1}{4} \) is written as a one over a four with a horizontal line separating them. There’s a one (the part) over a four (the whole).

\( \frac{part}{whole} \)

But what does that mean?

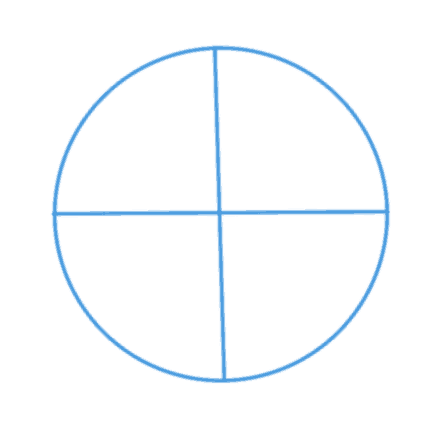

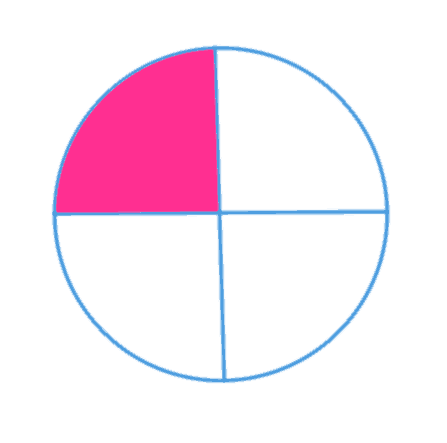

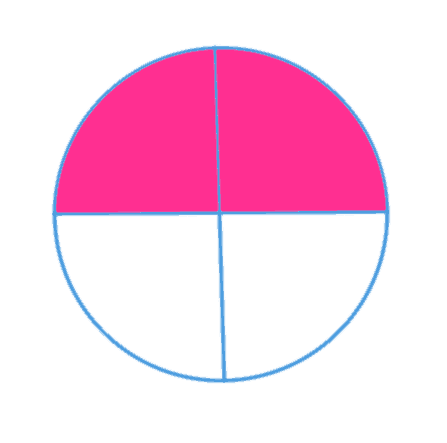

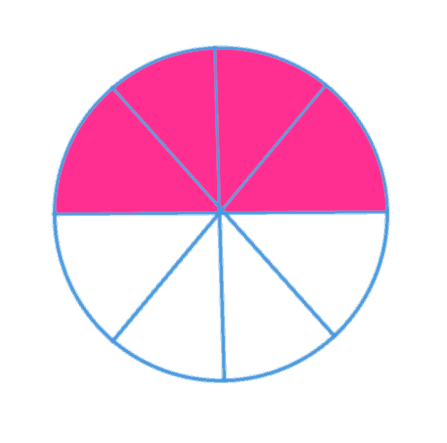

To better understand let’s look at a pie. In our example the whole (the bottom part) has four pieces so let’s break our pie up into four pieces. If you were to have all four pieces then you’d have the whole pie, right?

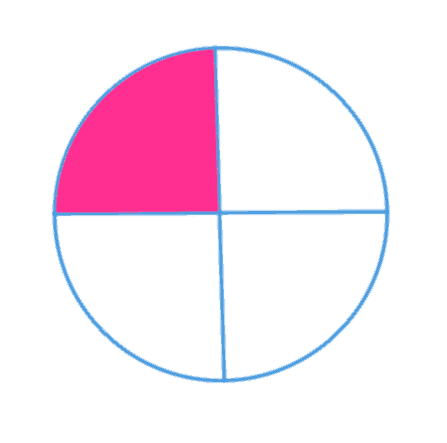

But we only want one part so our pie would look like this.

That is \( \frac{1}{4} \) of the pie. It’s one piece out of four possible.

So far, we’ve been using the terms “parts” and “whole” because those words match up with the definition of a fraction, but mathematicians don’t usually like to name things so they’re easy to remember.

The number on top, the one that we’ve been calling the “part” is called the “numerator.”

The number on the bottom, the one that we’ve been calling the “whole” is called the “denominator.”

\( \frac{numerator}{denominator} \)

If you ever forget which one goes on top and which one goes on the bottom think of “D” for “Down,” the Denominator goes down, which means that the numerator would go up.

Looking back at our pie above we can see that one is the numerator and four is the denominator.

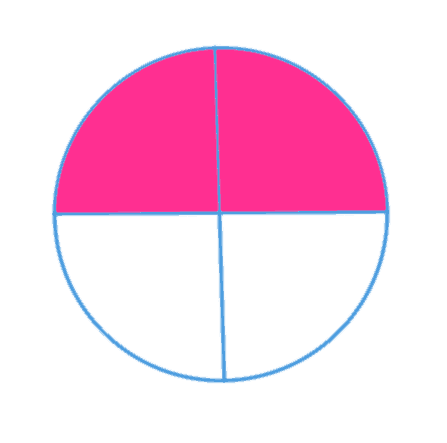

Suppose we’re starving and we want two parts of the pie.

Two would become the numerator, and the denominator would stay the same because we still have four total parts that make up the whole.

But something interesting just happened. We can easily see that the pie is half gone.

So just by observing, we can see that \( \frac{2}{4} \) equals \( \frac{1}{2} \), but let’s look at the math behind it.

Whenever we have a fraction we may be able to simplify it. We do this by finding a common factor—something that each number can be divided by.

In the case of \( \frac{2}{4} \) both the numerator (two) and denominator (four) can be divided by two. How did we know that? It’s because we know our times tables. If you don’t know yours it’s a good idea to review them before your exam. Yes, you can use a calculator but finding factors and simplifying equations is a lot easier if you know them.

So, let’s go ahead and divide both the numerator and denominator by two.

\( 2 \div 2 = 1 \)

\( 4 \div 2 = 2 \)

Two divided by two equals one and four divided two equals two so the fraction \( \frac{2}{4} \) simplifies to \( \frac{1}{2} \).

Note that the reverse is also true. If you wanted to know what half of eight pieces of pie was you’d multiply the denominator (two) by four to get eight total pieces.

\( 4 \times 2 = 8 \)

How did we know to multiply two by four to get eight? It’s those times tables again. I’m starting with a two and I want to get eight. I know that two times four is eight so I use four as my factor.

Since you multiplied the denominator by four you’d also multiply the numerator (one) by four to get four pieces.

\( 1 \times 4 = 4 \)

So four pieces out of eight (\( \frac{4}{8} \)) would be half of an eight piece pie.

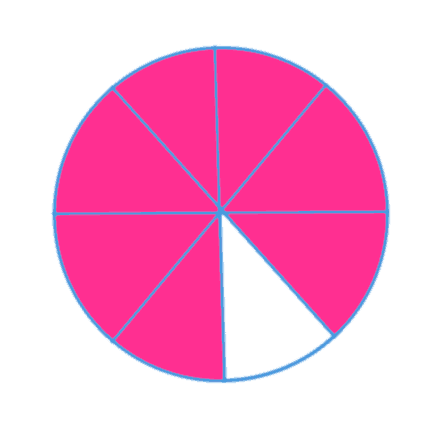

Now suppose we had \( \frac{7}{8} \) of our pie.

Could we simplify? We can’t because there isn’t a common factor between seven and eight.

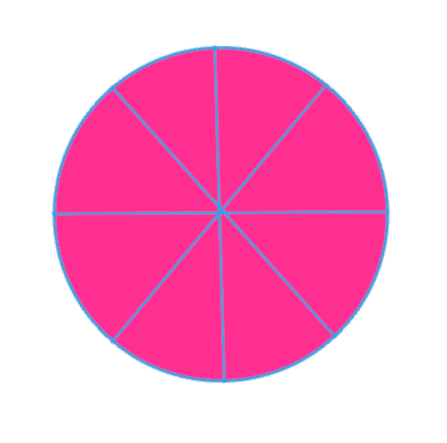

What if we had \( \frac{8}{8} \) of our pie?

We can easily see that this is the whole pie, but this also gives us the opportunity to learn something else. Fractions are really division.

If you don’t believe me just divide eight by eight. What did you get? You got one, right? You got one whole pie.

\( 8 \div 8 = 1 \)

This also works if we simplified the fraction. \( \frac{8}{8} \) would simplify to \( \frac{1}{1} \) and one divided by one is one.

\( 1 \div 1 = 1 \)

If you divided a fraction where the numerator and denominator were not the same, you’d get a decimal number, but that’s a topic for later.

Adding and Subtracting Fractions

Suppose my friend cut up a cherry pie into four equal pieces. My friend then put one piece on my plate. It would look something like this.

I mentioned to my friend that I love cherry pie and haven’t had it in years. So my friend immediately put another piece on my plate, which now looked something like this.

Let's think about what just happened in math terms. After my friend placed the first piece on my plate I had \( \frac{1}{4} \) of the pie on my plate. After the second piece was added I had \( \frac{2}{4} \) of the pie on my plate.

\( \frac{1}{4} + \frac{1}{4} = \frac{2}{4} \)

That was a pretty basic and easy example, but it's best to start simple. And we already know that \( \frac{2}{4}\) simplifies to \(\frac{1}{2} \).

In fact adding and subtracting fractions is pretty simple. All you have to do is add or subtract the numerators. But there is one catch: the denominators have to be the same. Remember the difference between the numerator and denominator? Think d for down. The denominator goes down.

\( \frac{numerator}{denominator} \)

In our example, we were talking about pieces of the same pie so we already had a common denominator (one that's the same). It was four because there were four pieces.

But what happens when we want to add a fraction that doesn't have a common denominator? We have to make the problems have a common denominator ourselves.

Remember how we figured out in a previous topic that \( \frac{1}{2} \) of a pie was the same as \( \frac{4}{8} \) of a pie? If you don't you should probably go back and review again.

But we figured out they were the same because we multiplied both the numerator and denominator by the same number (which was four in that example). That means we are able to multiply the numerators and denominators of each fraction by the same number to get a new denominator and an equal fraction.

Let's try the following problem.

\( \frac{1}{4} + \frac{3}{8} = \)

This one's pretty simple. The denominators are four and eight and we know that \( 4 \times 2 = 8 \) so let's multiply both the numerator and denominator of \( \frac{1}{4} \) by two.

\( \frac{1 \times 2}{4 \times 2} + \frac{3}{8} = \)

It might look a bit confusing when it's part of a larger problem, but all we did was change the first fraction so it has a denominator of eight, so it matches the second fraction.

After doing the multiplication, the new problem will look like this.

\( \frac{2}{8} + \frac{3}{8} = \)

Let's review before moving on. Since we wanted an eight and know that we'd need to multiply the current denominator of four by two to get eight we go ahead and do that. But if we multiply the denominator we need to multiply the numerator by the same number so we did that too.

Since the denominators are now the same we can simply add the numerators to solve the problem.

\( \frac{2}{8} + \frac{3}{8} = \frac{5}{8} \)

But what happens when we look at the denominators and can't figure out a common denominator? We can simply multiply both denominators to find one.

\( \frac{6}{8} + \frac{4}{9} = \)

In this example we'd multiply eight by nine to find the common denominator of 72.

\( 8 \times 9 = 72 \)

So we know that our common denominator is 72, but what do we do with the numerators? We have to multiply those too.

\( \frac{6\times 9}{8 \times 9} + \frac{4 \times 8}{9 \times 8} = \)

Notice that we're multiplying the numerator and denominator of each fraction by the denominator of the other fraction. When we complete the multiplication, our problem will become much more solvable.

\( \frac{54}{72} + \frac{32}{72} = \)

Now, we add the numerators and keep the denominators the same.

\( \frac{54}{72} + \frac{32}{72} = \frac{86}{72} \)

It's common practice to simplify fractions by dividing the numerator and denominator by a common factor. I can see clearly that two is a common factor because these are both even numbers. So, let's divide both the numerator and denominator by two.

\( \frac{86 \div 2}{72 \div 2} = \frac{43}{36} \)

Also notice that the numerator is greater than the denominator. That's what's called an improper fraction. An improper fraction can be converted into a mixed number. What's a mixed number? Let's make one to see.

The first step is to see how many times the denominator will fit in the numerator. In this example I know that 36 fits into 43 one time. How do I know that? Because if I tried more times I'd go over. The point is to see how many times the numerator fits and get as close as you can without going over. It's sort of like that game show.

The next step is to see how much I left in the numerator. Since 36 only went in one time I can simply subtract 36 from 43, but that wouldn't necessarily work out in problems where it goes in more than once. So let's do it that way even though we don't need to just to learn something.

\( 43-(36 \times 1) = 43-36 = 7 \)

I multiplied 36 times one because it went in one time. So now, if you have a problem that goes in more times, you'll know how to figure it out. I completed solving using PEMDAS. Remember PEMDAS?

The one time that 36 went into 43 becomes a big number one, and the seven remains part of the original fraction.

\( \frac{43}{36} = 1\frac{7}{36} \)

The improper fraction \( \frac{43}{36} \) converts into the mixed number \( 1\frac{7}{36} \).

You might have to add or subtract mixed numbers. Before you do anything else you must convert it into an improper fraction. We do this by doing the opposite of what we just did.

Suppose we wanted to convert the following mixed number into an improper fraction.

\( 4\frac{3}{8} \)

While keeping the denominator we multiply the whole number (four) by the denominator (eight) and add it to the numerator (three).

\( \frac{4 \times 8 + 3}{8} = \frac{35}{8} \)

If we were adding or subtracting mixed numbers, we could go on to finding a common denominator, if needed.

We've come a long way and I haven't taught how to subtract yet. That's because it's exactly the same as addition, except you subtract after you have common denominators instead of adding. Here's a summary of the entire process.

- Convert any mixed numbers into improper fractions.

- Find a common denominator if there isn't one already.

- Add or subtract the numerators while keeping the denominator the same.

- Simplify

Fraction Formulas

The following formulas summarize what was explained above using variables.

\( \frac{a}{b} + \frac{c}{b} = \frac{a+c}{b} \)

\( \frac{a}{b} + \frac{c}{d} = \frac{a \times d + b \times c}{b \times d} \)

\( \frac{a}{b} - \frac{c}{b} = \frac{a-c}{b} \)

\( \frac{a}{b} - \frac{c}{d} = \frac{a \times d - b \times c}{b \times d} \)

Adding and Subtracting Fractions Quiz

\( \frac{1}{2}+\frac{1}{4}= \)

- \( \frac{3}{4} \)

- \( \frac{2}{2} \)

- \( \frac{2}{4} \)

- \( \frac{3}{2} \)

Click for the Answer and Explanation

Answer: \( \frac{3}{4} \)

Explanation: We use the common denominator of 4 and solve \( \frac{2}{4}+\frac{1}{4}=\frac{3}{4} \)

\( \frac{2}{3}-\frac{1}{3}= \)

- 2

- \( \frac{1}{3} \)

- \( \frac{2}{3} \)

- 0

Click for the Answer and Explanation

Answer: \( \frac{1}{3} \)

Explanation: There is already a common denominator, so we subtract the numerator and keep the denominator the same. \( \frac{2}{3}-\frac{1}{3}=\frac{1}{3} \)

Multiplying and Dividing Fractions

After reviewing how to add and subtract fractions you might be worried about all of the steps required to multiply and divide them. Don't worry. It's actually much easier. You don't need to find a common denominator.

To multiply fractions you simply multiply the numerator by the numerator and the denominator by the denominator.

\( \frac{3}{4} \times \frac{2}{5} = \frac{3 \times 2}{4 \times 5}= \frac{6}{10} = \frac{3}{5} \)

Let's break that down a bit. First we rewrote \( \frac{3}{4} \times \frac{2}{5} \) as \( \frac{3 \times 2}{4 \times 5} \) to clearly see that we're simply multiplying the numerators together and the denominators together.

We then solved the multiplication to reach the answer of \( \frac{6}{10} \), which I then simplified to \( \frac{3}{5}\) by dividing both the numerator and denominator by two. I didn't show it above, but the equation would be \( \frac{6 \div 2}{10 \div 2}=\frac{3}{5} \).

Dividing fractions is almost exactly the same as multiplying them. I take that back. Dividing fractions is exactly the same as multiplying them. You just have to do one thing first.

\( \frac{5}{8} \div \frac{1}{3} \)

To divide this fraction we simply flip the divisor (the \( \frac{1}{3} \) and then multiply. To flip the fraction you turn it upside down so \( \frac{1}{3} \) becomes \( \frac{3}{1} \). Our division problem has now become a multiplication problem and we already know how to solve those.

\( \frac{5}{8} \times \frac{3}{1}=\frac{5 \times 3}{8 \times 1}=\frac{15}{8}=1\frac{7}{8} \)

I won't explain all the steps here because you should be familiar with them already. If not you should probably go back and re-review.

Fraction Formulas

The following formulas summarize what was explained above using variables.

\( \frac{a}{b} \times \frac{c}{d} = \frac{a \times c}{b \times d} \)

\( \frac{a}{b} \div \frac{c}{d} = \frac{a}{b} \times \frac{d}{c} = \frac{a \times d}{b \times c} \)

Multiplying and Dividing Fractions Quiz

\( \frac{1}{3} \times \frac{2}{5}= \)

- \( \frac{2}{15} \)

- \( \frac{1}{15} \)

- \( \frac{2}{5} \)

- \( \frac{2}{3} \)

Click for the Answer and Explanation

Answer: \( \frac{2}{15} \)

Explanation: To multiply fractions, we multiply the numerator by the numerator and the denominator by the denominator. \( \frac{1}{3} \times \frac{2}{5}=\frac{2}{15} \)

\( \frac{5}{6} \div \frac{8}{9}= \)

- \( \frac{45}{48} \)

- \( \frac{5}{8} \)

- \( \frac{9}{6} \)

- \( \frac{4}{3} \)

Click for the Answer and Explanation

Answer: \( \frac{45}{48} \)

Explanation: To divide fractions, we flip the divisor and then multiply the numerator by the numerator and the denominator by the denominator. \( \frac{5}{6} \times \frac{9}{8}=\frac{45}{48} \)

Decimals

A decimal is really a fraction, but it's based on a power of ten. If that sounds confusing rest assured that it won't be once you read this section.

We'll review what decimals are and then move on to reviewing how to round them. We won't review the basic operations (addition, subtraction, multiplication, and division) of decimals because you can do those on your calculator.

Okay, it's time for something obvious. A decimal number is a number that's written with a decimal point. Profound, right?

A decimal number has a whole number part and a decimal part. The decimal part represents a partial number similar to a fraction. The part to the left of the fraction is the whole number part and the part to the right of the fraction is the decimal part.

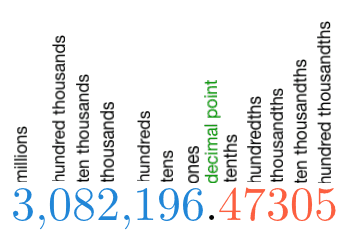

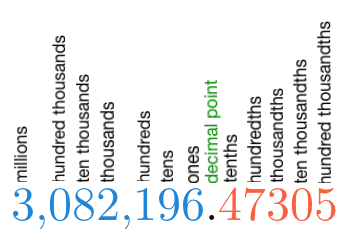

Let's look at a big decimal number.

\( 3,082,196.47305 \)

Wow, impressive, right?

Seriously, though, the most important thing to remember about decimals is that they're really just another way of expressing a fraction.

We're interested in the red numbers. Those are the decimal numbers. They're after the decimal point.

I'm getting a bit ahead of myself here since we'll officially be reviewing how to convert decimals to fractions in a later section but look at the red four. It's in the tenths place. You'd say "four tenths" if you wanted to pronounce that number.

You can also write "four tenths" as the fraction \( \frac{4}{10} \), which (probably not coincidentally) you'd also pronounce as "four tenths."

And the entire decimal portion would be pronounced "forty-seven thousand three hundred and five hundred thousandths," which could also be written as \( \frac{47,305}{100,000} \).

Decimals Quiz

What number is in the thousandths place?

\( 1,234.5678 \)

- 1

- 7

- 6

- 8

Click for the Answer and Explanation

Answer: 7

Feedback: The number 7 is in the thousandths place.

Rounding Numbers and Decimals

To round a number just means to approximate it to the nearest easier, more interesting, or more appropriate number. We might round numbers when we're shopping. If something costs $5.90 we might think of it as $6 to make adding it up in our head with the rest of the items we want to buy easier.

Rounding makes solving more difficult problems easier if we're not worried about accuracy. Unfortunately accuracy is very important in a serious real estate transaction or investment transaction because money is involved, but there are some cases where rounding can come in handy.

As an example, we might round to cents if we're dealing with an annual interest rate, on our mortgage payments principal because we can't pay in fractions of a cent.

Suppose a client wanted to know how much paint would be needed to cover a room. You might round the measurements to make calculating the area in your head easier.

So how do you round? The magic number is five. Anything less than five rounds down and anything five or greater rounds up. That's seriously all you need to know.

Let's look at the number 36. Suppose you wanted to round this to the nearest ten. That means it's either going to round up to 40 or round down to 30.

The number we're interested in looking at is the 6. That's the number right next to the place value that we're rounding to (tens) so it determines how the number is rounded.

Remember our magic number five? Six is greater than five so we round up. 36 rounds up to 40.

Let's look at a different number. Let's round 6,842 to the hundreds place. That means our rounded number will either be 6,800 or 6,900.

The number just to the right of the number we're rounding is four. Four is less than the magic number five so we round down. The answer is 6,800.

Decimals are rounded the same as whole numbers. The most difficult part is remembering what all the place values are called. To help here's the graphic from the last topic.

Suppose you were asked to round 704.235 to the hundredths place.

First, don't get confused and think you're rounding to the hundreds place. There's a "ths" at the end. If a place value ends in a "ths" you know that you are dealing with the decimal portion.

The number that is in the hundredths place of the number 704.235 is the number three. So that means our number is going to round up to 704.240 or round down to 704.230.

The number right next to the number we're rounding is a five. That's our magic number. Remember that we round up if the number is greater than or equal to five. So the rounded number is 704.240.

But we can drop the zero since trailing zeros in the decimal portion just mean nothing's in those places. Not writing anything in those places means the same thing and looks much cleaner. So our number becomes 704.24.

Rounding Numbers and Decimals Quiz

Round to the nearest hundredth.

\( 56.4623 \)

- 56.4

- 56.4623

- 100

- 56.46

Click for the Answer and Explanation

Answer: 56.46

Explanation: 56.4623 rounded to the nearest hundredth is 56.46. We look at the digit in the thousandths place (2) to decide to round up or down. Since 2 is below 5 we round down and the 6 does not change.

Round to the nearest tenth.

\( 42.764 \)

- 42.7

- 42.76

- 42.8

- 42.764

Click for the Answer and Explanation

Answer: 42.8

Explanation: 42.764 rounded to the nearest tenth is 42.8. We look at the number in the hundredths place (the 6) and see that it is greater than or equal to five so we round the digit in the tenths place up to 8.

Percents and Converting Percents, Decimals, and Fractions

Many math questions on the Real Estate License Exam have to deal with percentages. In this section we'll review what a percentage is and how to convert between decimals, fractions, and percentages.

A percentage is simply a fraction, but the denominator is always 100. So 75% means \( \frac{75}{100} \).

But even though percentages are based on a total of 100, most totals aren't exactly 100. You might need a 70% or a 75% to pass your Real Estate License Exam, but there might not be 100 questions. How can you calculate a percent based on a total that is not equal to 100?

Hint: You use the conversions in the following sections.

Convert Fractions to Decimals

Suppose there are 85 questions on your Real Estate License Exam, you need a 75% to pass and you get 64 of them right? Did you pass?

You got 64 out of 85 correct. Any time you hear the words "out of" you're hearing about a fraction. That means that we can write "64 out of 85" like this: \( \frac{64}{85} \).

I've hinted about it in previous sections, but fractions are really division. \( \frac{64}{85} \) is the same as \( 64 \div 85 \). If you put that into your calculator you'll get 0.7529411765. We just converted a fraction into a decimal! All you have to do is divide.

Convert Fractions to Decimals Quiz

Convert the following fraction to a decimal.

\( \frac{5}{8} \)

- 0.85

- 0.625

- 0.58

- 62.5%

Click for the Answer and Explanation

Answer: 0.625

Explanation: \( \frac{5}{8}=5 \div 8 = 0.625 \)

Convert Decimals to Percents

To convert that decimal to a percentage we just need to round to the nearest hundredth and then multiply by 100.

You won't always have to round and in many cases it may be a bad idea, but test scores are typically rounded.

0.7529411765 rounded to the nearest hundredth would be 0.75. We then multiply 0.75 by 100 to get the percent.

\( 0.75 \times 100 = 75 \)

64 out of 85 correct is a 75%. Congratulations, you passed, but barely. Keep studying to be sure to get a higher score on the real test!

For some problems rounding might not be necessary. You'll be able to tell by the language in the problem and the answer choices given.

If the problem says to round to a certain number, then do it. If it doesn't say to round so you don't, but you do not see your answer in the list of choices try rounding to see if your answer is there.

Test writers can be sneaky, but they usually won't give you a problem where rounding will be necessary unless they tell you to round.

Convert Decimals to Percents Quiz

Convert the following decimal to a percent. Do not round.

\( .645 \)

- 645%

- 56%

- 6.45%

- 64.5%

Click for the Answer and Explanation

Answer: 64.5%

Explanation: \( 0.645 = 64.5\% \) The problem specifically said not to round so 65% is incorrect.

Convert Decimals to Fractions

To convert a decimal to a fraction we have to do the reverse. Suppose we have that decimal 0.85.

We already learned that this means 85 hundredths. That means we can write it like this: \( \frac{85}{100} \). Hey, that's a fraction!

But since mathematicians like to simplify fractions, let's simplify that one. I can see that five is a factor of both the numerator and denominator.

\( \frac{85 \div 5}{100 \div 5}=\frac{17}{20} \)

Convert Decimals to Fractions Quiz

Convert the following decimal to a fraction.

\( 0.55 \)

- 55%

- \( \frac{11}{20} \)

- \( \frac{100}{55} \)

- \( \frac{55}{1000} \)

Click for the Answer and Explanation

Answer: \( \frac{11}{20} \)

Explanation: \( 0.55=\frac{55}{100}=\frac{11}{20} \)

Convert Percents to Decimals

To convert a percent to a decimal simply divide by 100. Let's turn 54% into a decimal.

\( 54 \div 100 = 0.54 \)

You can solve that on your calculator or just move the decimal point two places to the left.

Convert Percents to Decimals Quiz

Convert the following percent to a decimal.

\( 57\% \)

- 0.75

- \( \frac{57}{100} \)

- 0.57

- 0.7142857143

Click for the Answer and Explanation

Answer: 0.57

Explanation: 57% = 0.57

Geometry

There is a lot of geometry in real estate transactions. Don't stress out about it, though, because the geometry you need to know is pretty basic. All you need to know is a few simple formulas to calculate perimeter, area, and volume along with some more specific real estate calculations like square footage and acreage.

How Much Geometry Should You Know?

Unfortunately there are a lot of formulas in Geometry. Even worse, you might be asked a question on your real estate exam that involves any of them.

The good news, though, is that you’ll probably only see one question that involves having to use one of these formulas. And if you’re really lucky you might not see any.

So how much geometry should you know? The answer is that it depends.

If you have the time, you’ll maximize your chance of success if you memorize all of these math formulas here.

But if you don’t have the time to memorize real estate math formulas so it won’t hurt your score too bad.

The best news is that you’ll probably memorize enough simply going though the following sections and completing the quizzes.

Perimeter

The perimeter is the distance around a shape. If there was a fence around a lot, we could find the perimeter by counting our steps while walking around the lot.

Although that would technically be the perimeter, people's step sizes can vary so standard units of measurement like feet or yards are used.

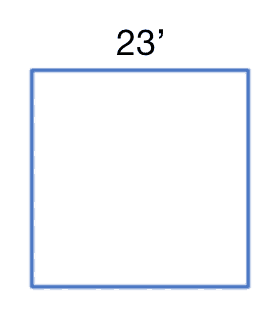

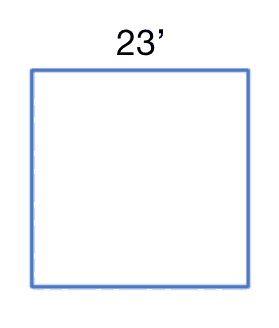

Perimeter of a Square

\( perimeter=4 \times length \)

By definition a square has four equal sides. That means that you only need to know one side to figure out the perimeter.

To find the perimeter of the square above we'd simply add up the lengths of all of the sides, which would be \( 23+23+23+23=92 \). The perimeter is 92 feet. Of course we could also use multiplication and multiply the length of the side by four. \( 23 \times 4 = 92 \).

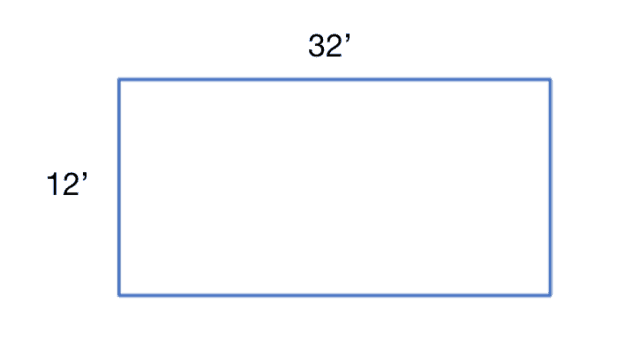

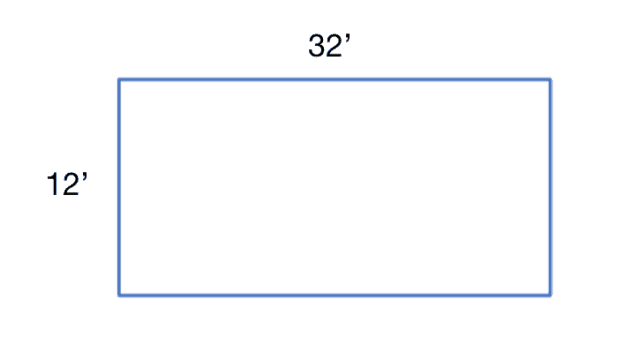

Perimeter of a Rectangle

\( perimeter=2 \times length + 2 \times width \)

A rectangle is a shape where the two widths are the same and the two lengths are the same. That means you might only be given one length and one width and have to find the perimeter.

To find the perimeter of the above rectangle we'd add up the all of the sides. We're only given one length and one width, but we know that the opposite sides have the same measurements. So we would just add the width twice to the length twice. \( 12+12+32+32=88 \). We can also use multiplication. \( 2 \times 12 + 2 \times 32 = 88 \).

The formula says to use two times the length plus two times the width. Which is the length and which is the width? Usually, the longest side is the length, but it really doesn't matter which one you put where when calculating.

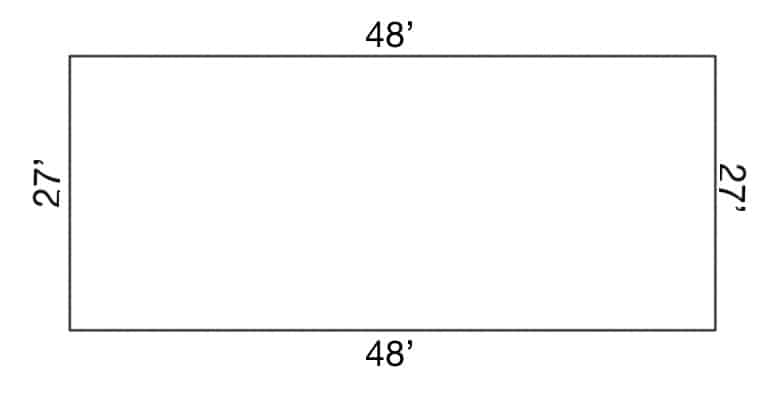

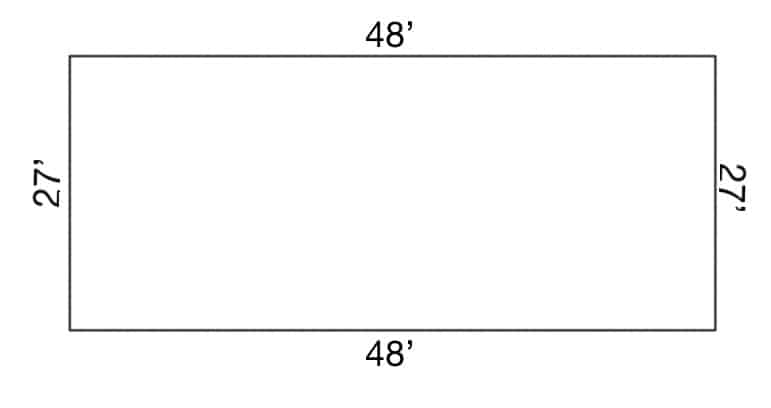

Perimeter of a Rectangle Quiz

What is the perimeter of the following shape?

- 1.296

- 150

- 45

- 27

Click for the Answer and Explanation

Answer: 150

Explanation: \( 27+27+48+48=150 \) We calculate perimeter by adding up the lengths of all of the sides.

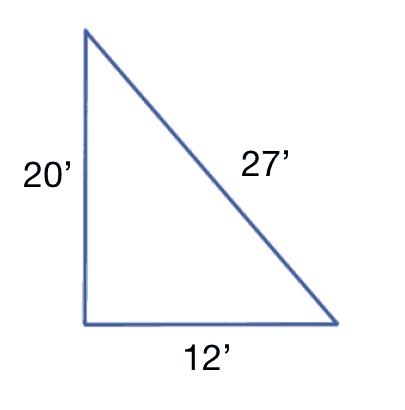

Perimeter of a Triangle

\( perimeter=a+b+c \)

The variables a, b, and c are the lengths of each side.

To calculate the perimeter of a triangle, simply add up all the sides.

The perimeter for the triangle above is \( 20+12+27=59 \).

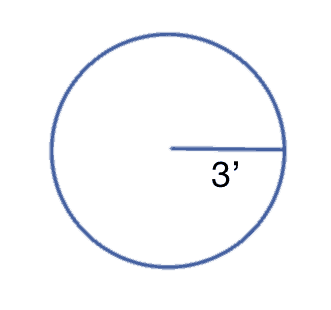

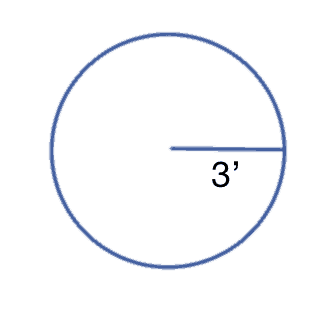

Circumference of a Circle

\( perimeter=2 \times \pi \times radius \)

So far all of the shapes have had nice straight lines for each side, but how do you find the perimeter of a circle? Officially a circle doesn't have a perimeter because mathematicians decided to call the length around a circle its circumference.

To find the circumference of a circle you multiply twice the radius by \( \pi \) (pronounced "pie"). What's the radius? That's the distance from the center of a circle to the side of the circle. What's \( \pi \)? It's the ratio between the circumference and diameter of a circle. The diameter is the the distance across the entire circle (twice the radius). \( \pi \) is a long decimal number but for our purposes we'll round it to the hundredths place and use the value 3.14.

The radius of the above circle is three. \( 3 \times 3.14 = 9.42 \). The circumference (or perimeter) of the circle is 9.42'.

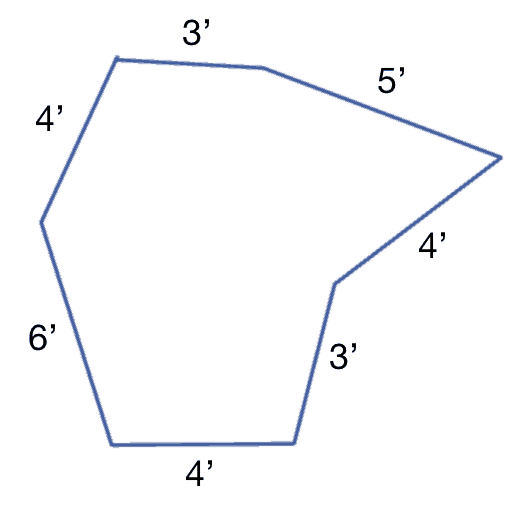

Perimeter of Nonstandard Shapes

To find the perimeter of any nonstandard shapes simply add the lengths of all the sides.

\( 3+5+4+3+4+6+4=29 \)

Area

The area is the amount of space that a space takes up in two different dimensions, length and width. One way to think of it is the amount of paint you'd need to cover a shape. A shape with double the area of another shape would need double the paint.

Paint's actually a great example because how much paint they'd need is a question your clients or customers might ask.

Area of a Square

\( area = length^2[ \)

To calculate the area of a square multiply the length by the width. Since all the sides are the same we can simplify the formula and just square the length. That mains raising it to the second power.

Let's calculate the area of the square above by squaring the length.

\( 23^2=539 \)

But notice that we didn't just multiply 23 by 23. We also multiplied feet by feet. A foot multiplied by a foot is a square foot, which you might see written as \( feet^2\) or \(ft^2 \). Anytime you see a measurement in square feet you know you're dealing with an area.

Since a square is a special type of rectangle you can also use the formula for a rectangle. That makes one fewer formula to memorize!

Area of a Rectangle

\( area=length \times width \)

To calculate the area of a rectangle, multiply the length by the width.

\( 12 \times 32 = 384 \). The area of the rectangle above is \( 385 \space ft^2 \).

Area of a Rectangle Quiz

What is the area of the following shape?

- 150

- 1,296

- 27

- 48

Click for the Answer and Explanation

Answer: 1,296

Explanation: \( 27 \times 48 = 1,296 \) The area of a rectangle is calculated by multiplying the length by the height.

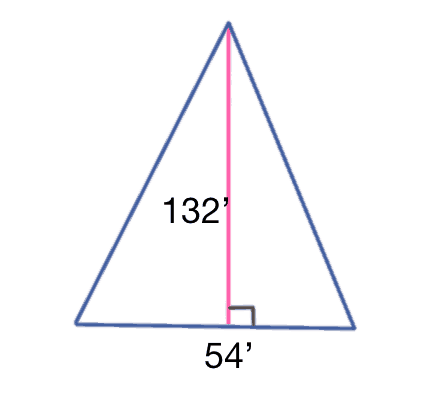

Area of a Triangle

\( area=base \times height \div 2 \)

The area of a triangle is one-half the base times the height.

In the triangle above, the base is 54 feet. The height (the pink line) is 132 feet. Notice that the height is not necessarily the length of a side. That's the case in the triangle above.

But imagine if we broke the triangle in half at the pink line. We'd then have two triangles and the length of one of the sides would be the height. That's because they are right triangles (one of the angles is exactly 90 degrees).

Let's stop imagining and get back to the original blue triangle. \( 132 \times 54 \div 2 = 3,564 \). The area of the triangle above is \( 3,564 \space feet^2 \).

Area of a Circle

\( area=\pi \times radius^2 \)

or

\( area=3.14 \times radius^2 \)

To calculate the area of a circle multiply \( \pi \) by the radius squared (remember that means times itself).

In the circle above the radius is 3 feet. The calculation would be \( \pi \times 3^2 \). Remember to calculate the exponent first so you don't break the rules of PEMDAS and accidentally get the wrong answer.

After calculating the exponent our new calculation would be \( \pi \times 9 \). After you plug \( 3.14 \times 9 \) into your calculator you'll get the answer of \( 28.26 \space ft^2 \).

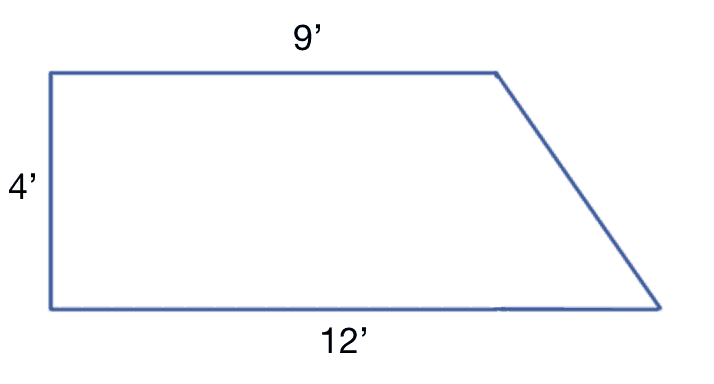

Area of Nonstandard Shapes

The area of nonstandard shapes can be calculated by combining all of the rules we've learned above.

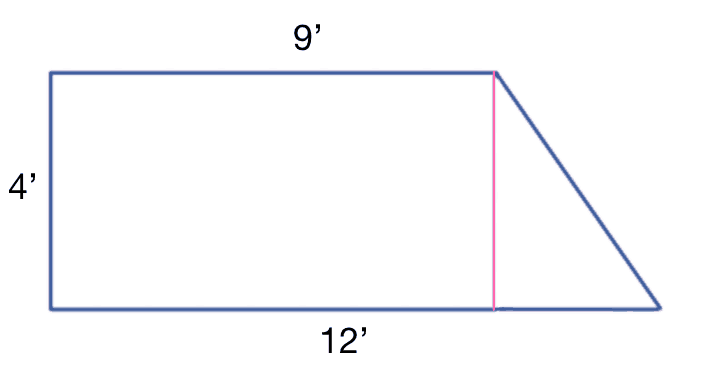

Your first reaction might be to think that this problem is impossible because I haven't given you a formula for it, but if you look closely you'll see a triangle next to a square.

Your first reaction might be to think that this problem is impossible because I haven't given you a formula for it, but if you look closely you'll see a triangle next to a square.

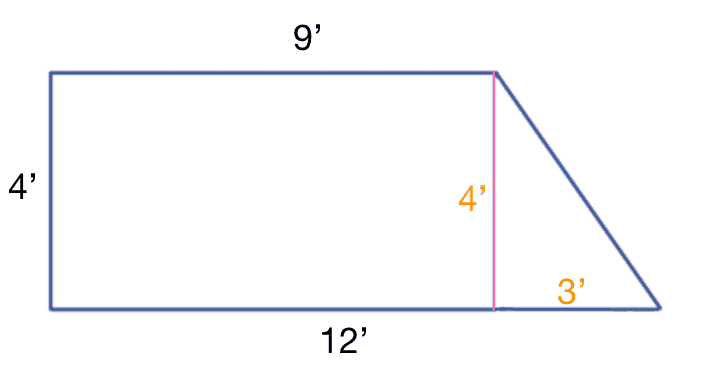

I added a pink line above to help. The next step is to fill in the missing measurements. We actually have all of the information we need to do so.

Obviously the height of the triangle is going to be 4' because it's the other side of the rectangle that we created by drawing the line.

We also know that the width of our rectangle is 9' but the width plus the base of the triangle is 12'. So we simply subtract 9 from 12 to find the base of the triangle.

Now we have to find the area of the square and the area of the triangle and add them together.

Let's start with the square first. Remember that the formula is \( area=length \times width \).

Plugging in our length of nine (don't confuse the 12 as the length since that measurement includes the base of the triangle) and width of four we get \( 9 \times 4 = 36 \). The area of the rectangle is \( 36 \space feet^2 \).

Let's move on to the triangle. Remember the formula is \( area=base \times height \div 2 \). The base of the triangle is 3' and the height is 4'. \( \frac{1}{2}\times4\times3=6 \). The area of the triangle is \( 6 \space feet^2 \).

Finally we add the area of the rectangle to the area of the triangle. \( 36+6=42 \). The area of the entire nonstandard shape is \( 42 \space feet^2@ \).

Volume

The volume of an object is how much physical space it takes up in three dimensions. Recall the area had to do with two dimensions: length and width. The third dimension used to calculate the volume is the height.

To calculate the volume of any basic shape, all you really have to do is find the area and then multiply by the height.

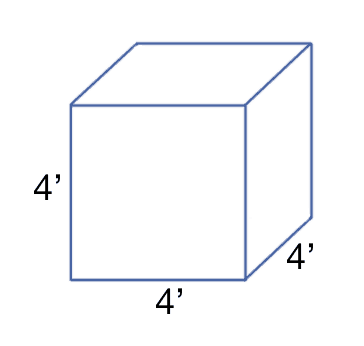

Volume of a Cube

\( volume=length^3 \)

A cube is an object where the length, width, and height are equal. Think of it as a square extended out to be as high as the length or width. Since the length, width, and height are equal we simply “cube” that one measurement. To “cube” a number is to raise it to the exponent of three.

All of the sides in the example cube above measure 4'. Let's plug that into the formula. \( 4^3=64 \). We also multiplied feet by feet by feet so we get an answer that is in cubic feet, or \( feet^3 \). The cube above has a volume of \( 34 \space feet^3 \).

I used the length in the formula above, but you can use the length, width, or height since they are all equal if the object is a cube.

Also, since a cube is a special kind of rectangular prism you can also use that formula. That makes one fewer formula to memorize!

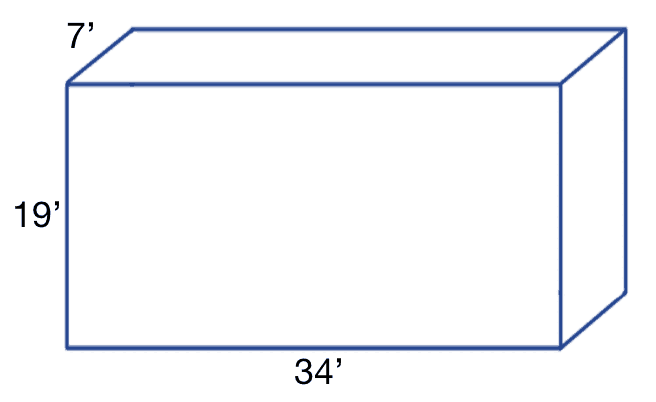

Volume of a Rectangular Prism

\( volume=length \times width \times height \)

A rectangular prism is a rectangle that has a height. To calculate the volume of a rectangular prism you multiply the length by the width by the height.

We multiple the length, width, and height of the above triangle to find its volume. \( 34 \times 19 \times 7 = 4,5224 \). The rectangular prism above has a volume of \( 4,522 \space ft^3 \).

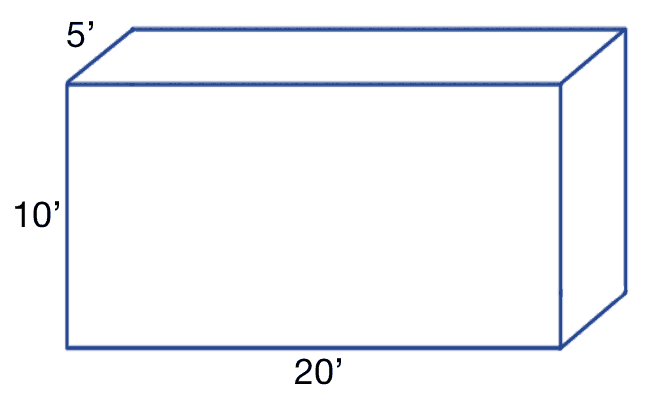

Volume of a Rectangular Prism Quiz

What is the volume of the following shape?

- \( 1,000 \)

- \( 1,000 \space ft^3 \)

- \( 1,000 \space ft \)

- \( 1,000 \space ft^2 \)

Click for the Answer and Explanation

Answer: \( 1,000 \space ft^3 \)

Explanation: To determine the volume of a rectangular prism we multiply the length by the width by the height. \( 10 \times 20 \times 5 = 1,000 \) Volume is expressed in cubic feet so the answer is \( 1,000 \space ft^3 \)

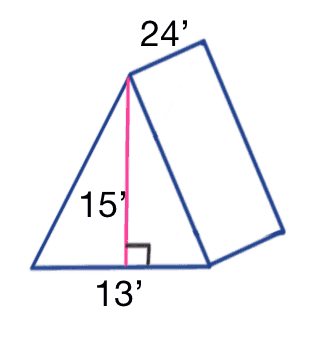

Volume of a Triangular Prism

\( volume=base \times height \div 2 \times length \)

A triangular prism is a shape with a triangular base that has height.

The image above is a triangular prism, but it's laying on its side. If you placed the triangle side down you would see a standard triangular prism. Why'd I draw it this way? First it's easier, but what's more important is that it looks like the top of a roof, which makes a lot more sense since this is about real estate.

Plugging our numbers into the formula we get \( 15 \times 13 \div 2 \times 24=2,300 \). The volume of the triangular prism above is \( 2,300 \space feet^3 \).

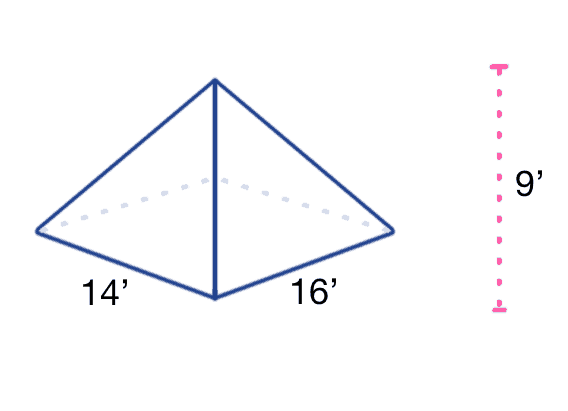

Volume of a Pyramid

\( volume = length \times width \div 3 \times height \)

A pyramid differs from a triangular prism because it has a rectangular base.

You might look at the bottom of the pyramid and think that it's a square because it looks like one. Don't trust how the drawings look because most of the time they are not drawn to scale and sneaky test writers try to trick you that way. Always trust the numbers instead of how the drawings look.

To get the volume of a pyramid, we calculate the area of the rectangular base, divide it by three, and then multiply by the height of the pyramid.

\( 14 \times 16 \div 3 \times 9 =672 \). The volume of the pyramid above is \( 672 \space feet^3 \).

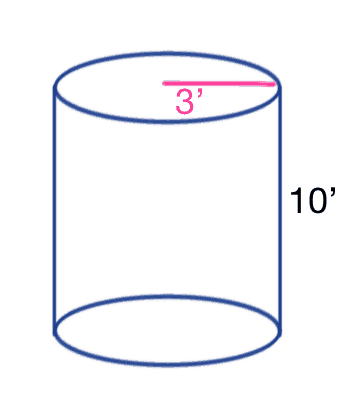

Volume of a Cylinder

\( volume=\pi \times radius^2 \times height \)

or

\( volume=3.14 \times radius^2 \times height \)

To get the volume of a cylinder we get the area of the circle base and then multiply it by the height.

The radius of the cylinder above is 3' and its height is 10'.

\( 3.14 \times 3^2 \times 10 =282.6 \)

The cylinder has a volume of \( 282.6 \space feet^3 \).

Real Estate Geometry Terms

After all of that Geometry review, it's finally time to apply it to real estate problems.

Number Conversions

| Measurement | Measurement | Measurement |

|---|---|---|

| 1 foot = | 12 inches | |

| 1 yard = | 3 feet | |

| 1 mile = | 1,760 yards = | 5,280 feet |

| 1 square foot = | 144 square inches | |

| 1 square yard = | 9 square feet | |

| 1 cubic yard = | 27 cubic feet | |

| 1 acre = | 43,560 square feet | |

| 1 square mile = | 640 acres = | 1 section |

| 1 township = | 36 sections |

Frontage

What do you picture when you think about the front of a property? If you're like me you think of the part that runs along the road. If you stood in the middle of the road and looked at the property you'd be looking at its front. That makes remembering the following term super easy. The length of a property that runs along a street or streets is known as the frontage.

Note that some exam questions might mention frontage along a body of water like an ocean, lake, or river. The problems are calculated the same way, but use the frontage along the body of water instead frontage along a street. But if the problem doesn't expressly state that the frontage is along something other than the street always assume the problem is asking for street frontage.

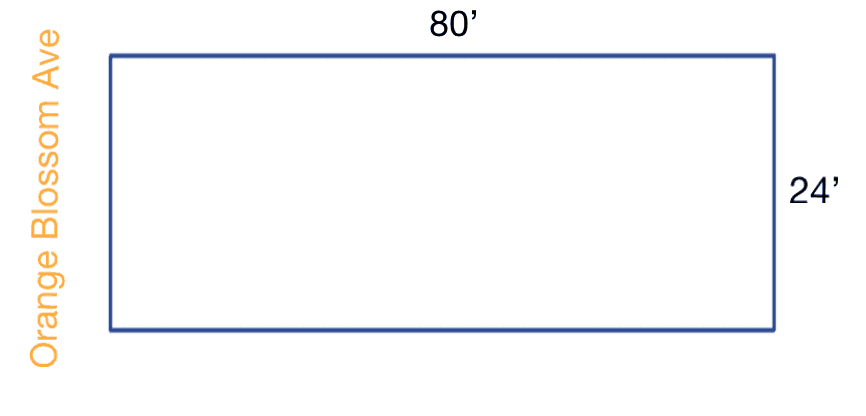

Suppose you were going to show this property on Orange Blossom Avenue to a customer. What would you say if the customer asked you what the frontage was? We can see that this property is a rectangle and the shorter side is the one that runs along Orange Blossom Avenue. This property has a frontage of 24 feet.

Frontage Quiz

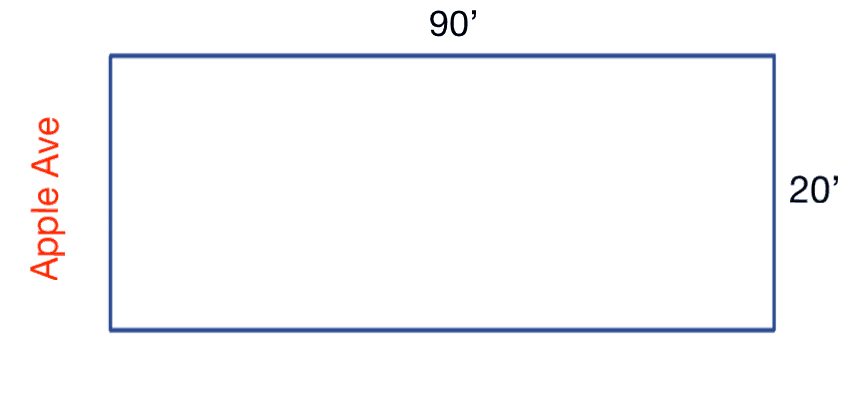

How many feet of frontage does this property have on Apple Ave?

- 20'

- 90'

- 1,000'

- None

Click for the Answer and Explanation

Answer: 20'

Feedback: This property is a rectangle, so it has the same amount of frontage as the width of the other side of the property, which is 20'

Acreage

\( acreage = feet^2 \div 43,560 \space feet^2 \)

How would you figure out the acreage of the property on Orange Blossom Ave in the frontage example above? The first step is to find the area. \( 80 \times 24 = 1,920 \). The area of this property is \( 1,920 \space feet^2 \) but you need the number in acres so let's use the formula. \( 1,920 \div 43,560 = .044 \). This property is .044 of an acre.

Of course you probably won't get an acreage problem that is this easy to solve. You'll probably get a problem where you first have to calculate a nonstandard area so it's also very important to have all of the area formulas memorized.

Acreage Quiz

How many acres is the property on Apple Ave pictured in the frontage quiz above?

- 4.500

- 0.041

- 1,800

- 24.200

Click for the Answer and Explanation

Answer: 0.041

Feedback: The first step is to find the area \( 90 \times 20=1,800 \) The area of this property is \( 1,800 \space feet^2 \) but you need the number in acres so let’s use the formula \( 1,800 \div 43,560=0.041 \) This property is 0.041 of an acre. We rounded to thousandths because all of the choices were that way.

Describing Real Estate

There are three different ways to describe real estate and only two of them require math.

- Metes and bounds

- Lot and block (also called the Subdivision plat system)

- Government Survey System

Metes and Bounds

The metes and bounds system isn’t used in new developments but was standard at the beginning of the United States.

It uses monuments to describe land. An example might be “Starting at the old oak tree head 20 feet West, then make a 90 degree turn West and head 90 feet…”

Obviously as the old oak tree grew or was chopped down it became difficult to measure the land.

You probably won’t see a question about this on the exam except for a definition. They might use a street name on the test instead of an old oak tree.

Lot and Block

The lot and block method (also called the Subdivision plat system) requires little to not math because all of the boundary lines, streets, actually measurements, and easements are recorded in a publicly available plot map, known as a plat.

You will not likely see a question about this other than perhaps a definition question.

Government Survey System

The Government Survey System does require that you know some math so let’s focus there.

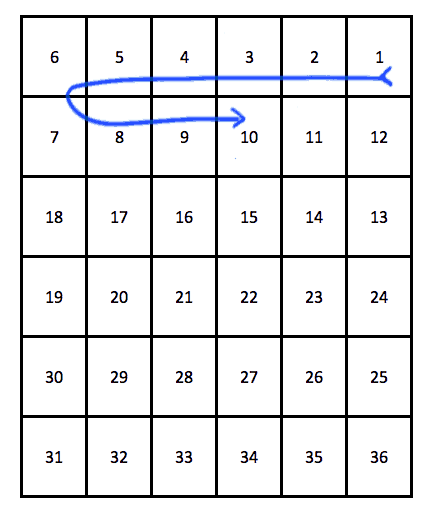

This survey system contains a six mile by six mile square that’s divided into 36 square miles. This is called a township.

The squares are numbered from one to thirty six, starting with number one at the top right and then moving in an S curve for the rest of the swarms. That means the it will move from right to left on the next row, left to right on the one after that, etc. I've added a blue line above to help you start to see the S curve in how they squares are numbered. I only added the top of the S. You'll have to continue to complete it.

Remember that a square mile contains 640 acres. That means that each of these one square mile sections contains 640 acres.

Questions that you might see on the exam involve dividing sections into smaller parcels.

How many acres are in \( \frac{1}{4} \) of one section?

We know that one section contains 640 acres so \( \frac{1}{4} \times 640 = 160 \). There are 160 acres in a quarter of a section.

HINT: If you have a basic calculator you could divide by 4 instead of multiplying by \( \frac{1}{4} \). Many states allow only a basic calculator on the exam.

One half of one eighth of a section sold for $23,000 per acre. What was the total sale price?

We'll use the hint above to solve this one more quickly. Just like we could have divided by four instead of multiplying by \( \frac{1}{4} \) we can divide by all the denominators in a chain.

We're interested in \( \frac{1}{2} \) of \( \frac{1}{8} \) of a section. To get the total acreage we just divide 640 by two and the result by eight. That's what I meant by dividing the denominators in a chain.

\( 640 \div 2 \div 8 = 40 \)

There are 40 acres in this parcel of land. It sold for $23,000 per acre. Let's multiply to get the total price.

\( 40 \times $23,000 = $920,000 \)

The total price of the land was $920,000.

Government Survey System Quiz

How many acres are in \( \frac{1}{2} \) of one section?

- 160

- 640

- 320

- 220

Click for the Answer and Explanation

Answer: 320

Explanation: We know that one section contains 640 acres, so \( \frac{1}{2} \times 640 = 320 \). There are 320 acres in a half of a section.

One-quarter of one half of a section sold for $20,000 per acre. What was the total sale price?

- $1,600,000

- $80

- $3,200,000

- $6,400,000

Click for the Answer and Explanation

Answer: $1,600,000

Explanation: We’re interested in \( \frac{1}{4} \) of \( \frac{1}{2} \) of a section. To get the total acreage we just divide 640 by four and the result by two. \( 640 \div 4 \div 2 = 80 \) There are 80 acres in this parcel of land. It sold for $20,000 per acre. Let’s multiply to get the total purchase price. \( 80 \times $20,000 = $1,600,000 \) The total price of the land was $1,600,000.

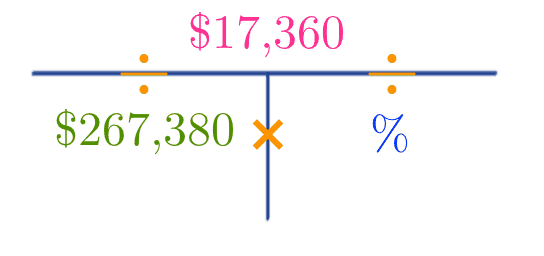

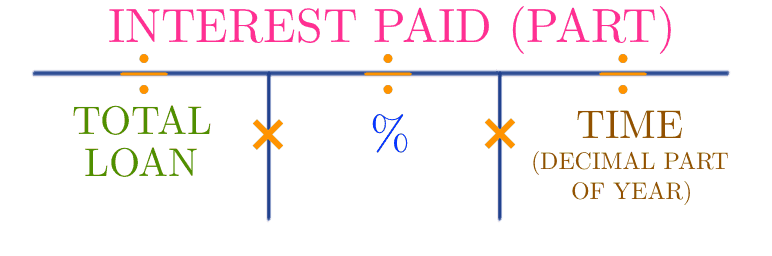

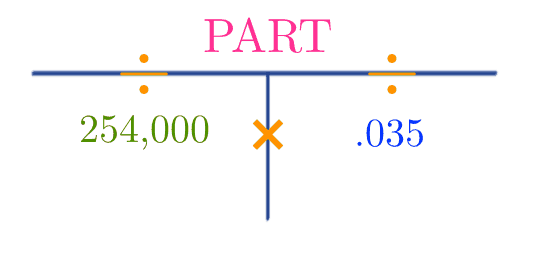

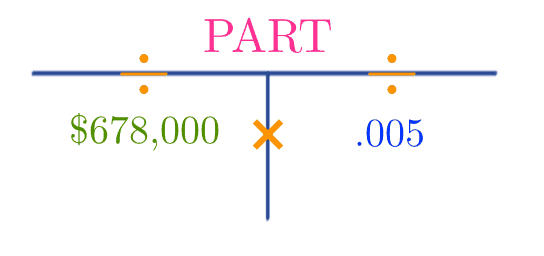

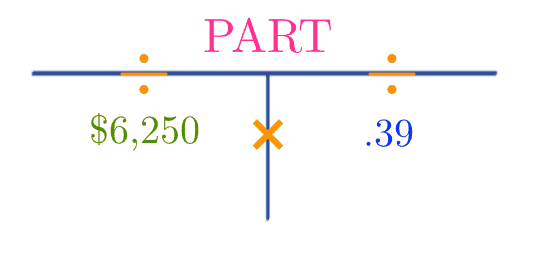

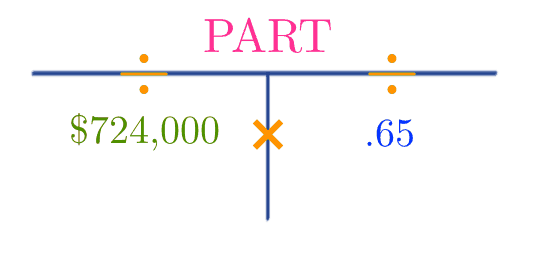

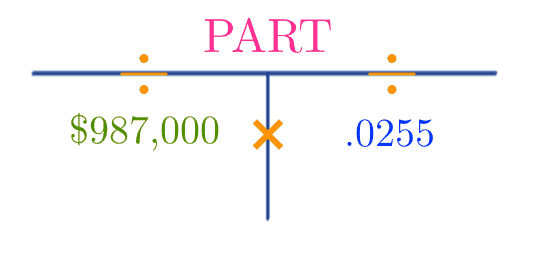

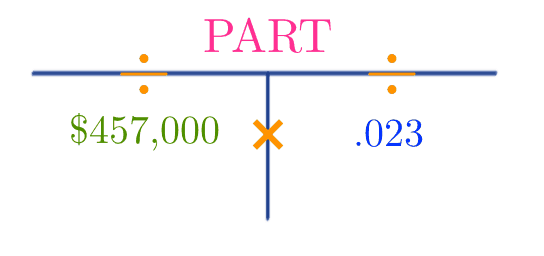

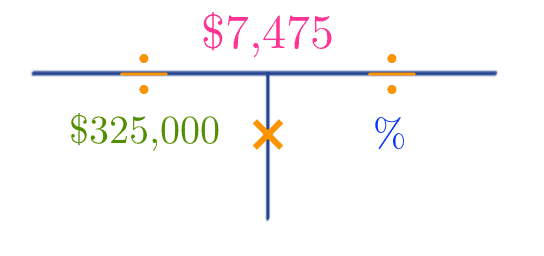

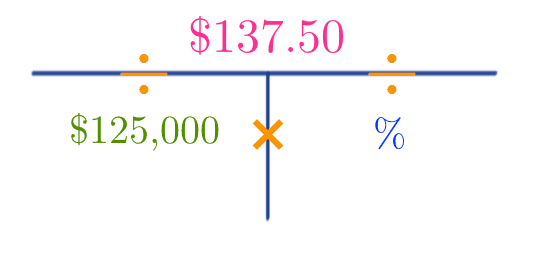

The T Method: One Formula to Solve Most Real Estate Problems

Believe it or not there's one formula that you can use to solve most Real Estate math problems. I say most because it's not going to help you with questions about area or volume, but the majority of questions on the Real Estate License Exam have to do with percentages and rates.

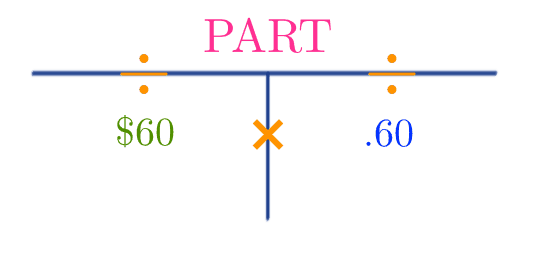

Drawing the T

Questions about commissions, the annual interest rate, rates, taxes, and more are all the same type of math problem with different vocabulary used.

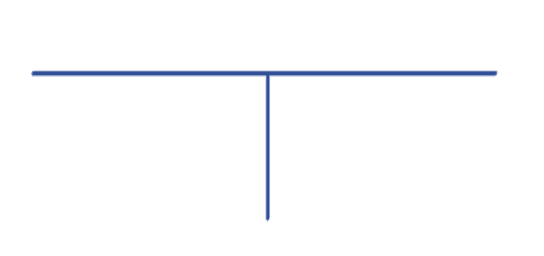

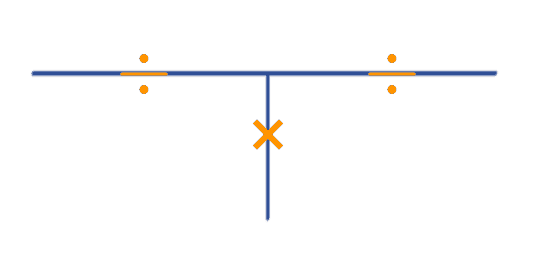

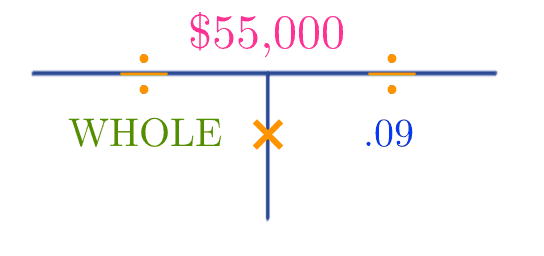

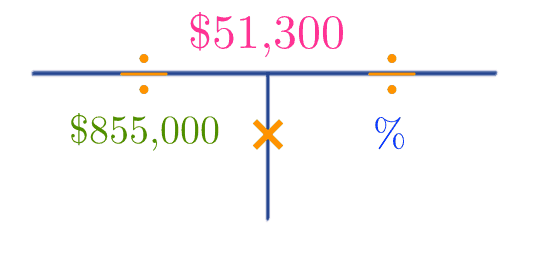

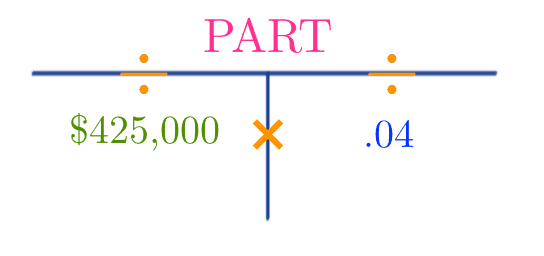

The good news is that there's one simple formula that you can use to solve most of these rate problems. It's called the T method. Why's it called the T method? It's because we start by drawing a big T.

Beautiful, isn't it? The next step is going to look a little weird, but just hang in there.

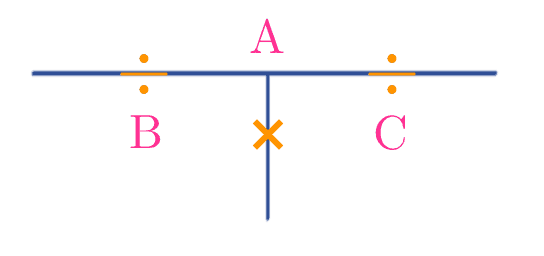

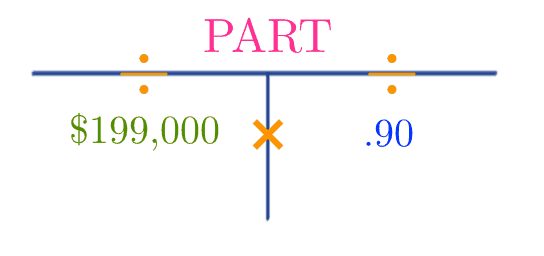

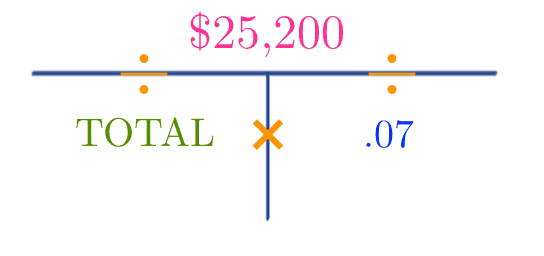

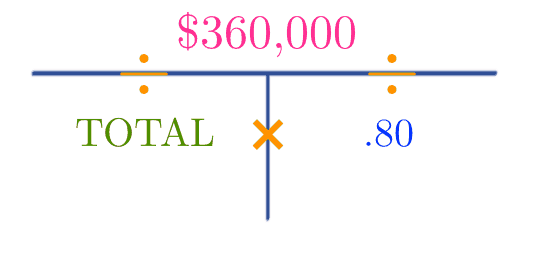

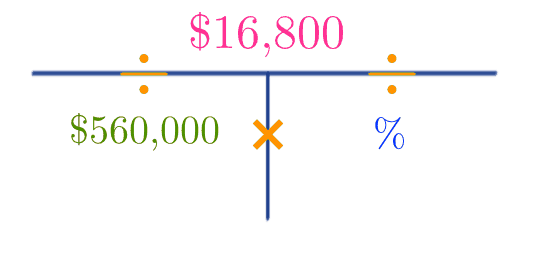

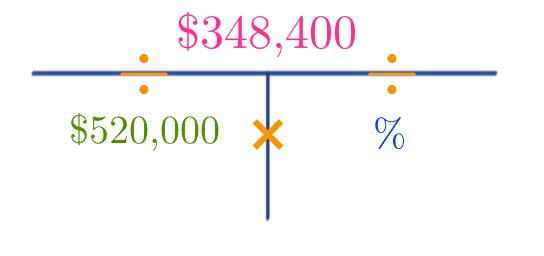

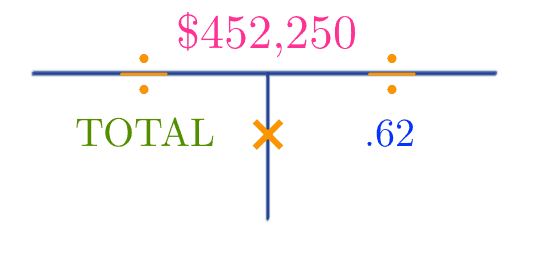

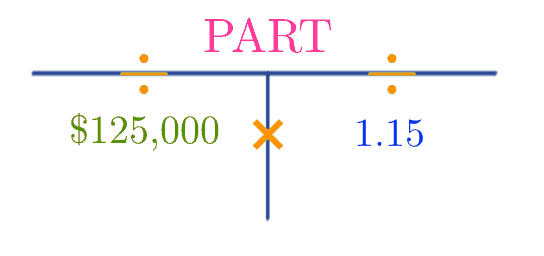

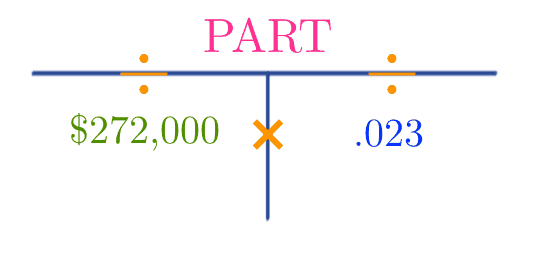

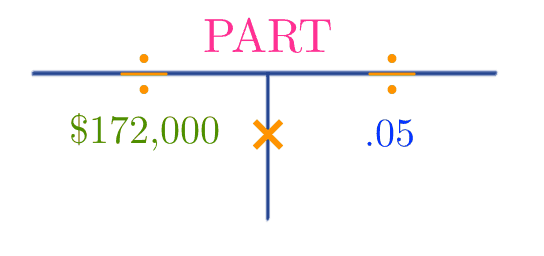

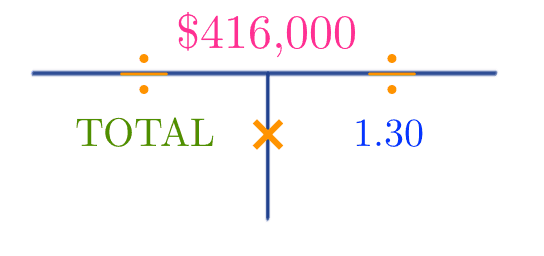

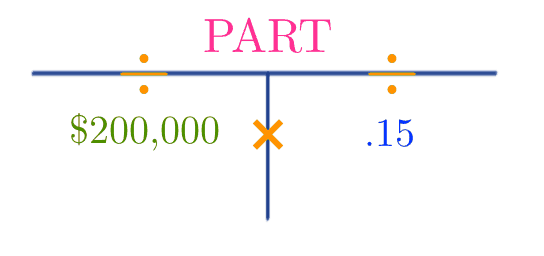

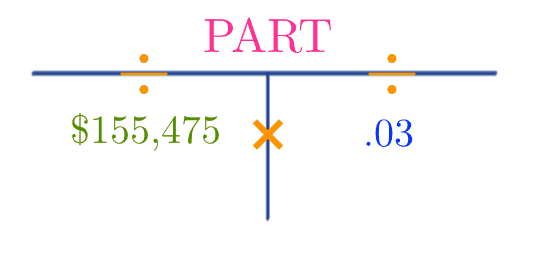

In a little while we're going to be putting a number at the top of the T, another number on the bottom left, and another on the bottom right. But before we get there let's put in some letters.

Now we can talk about what those operation symbols mean. The horizontal line of the T shows us the numbers that need to be divided and the vertical line shows us the numbers (technically letters in this example) that need to be multiplied.

In your problems you'll only have two of these numbers. If you were given A and B you'd divide A by B to get C. Does that make sense? If you think about it the T makes A over B look a bit like a fraction: \( \frac{A}{B}=C \). And we already reviewed that fractions are really division.

What if you were given A and C? You'd divide A by C to get B: \( \frac{A}{C}=B \).

The only one that's different is if you were given B and C. Can you guess what to do? If you said multiply you're right, but let me explain some more. The line between A and B not only makes A over B look like a fraction, but it also lets you know which operation (division or multiplication) to perform. There's only one line between B and C and it has a multiplication symbol. So we multiply.

If you can draw the T and remember what operations go with which lines then you're ready to move on.

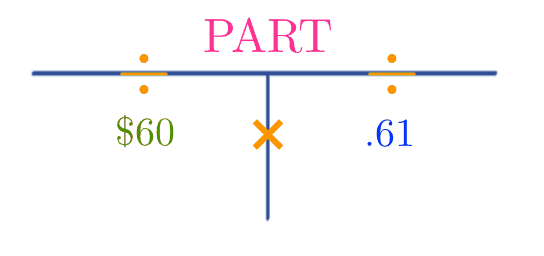

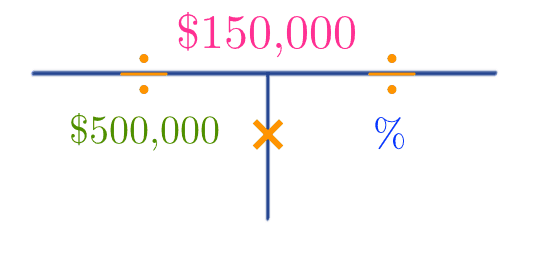

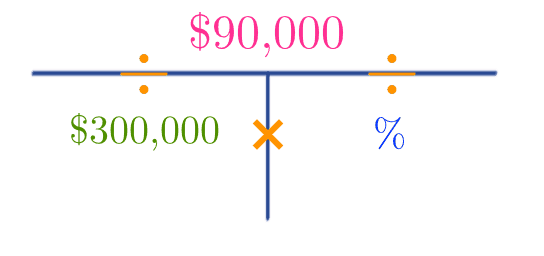

Using the T

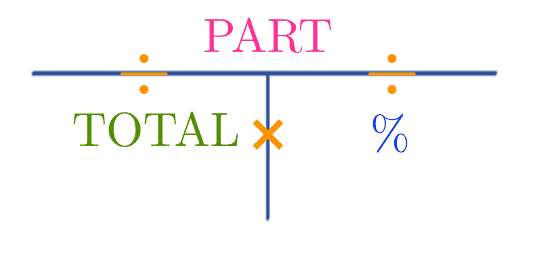

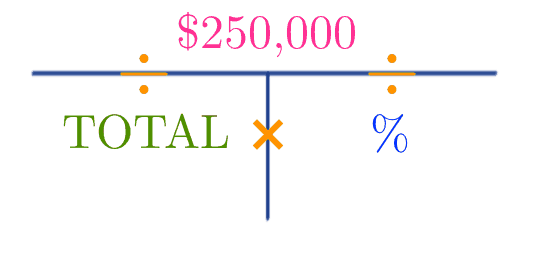

You won't be given As, Bs, or Cs in your problems. You'll be given a part, a total, or a percent. Each of those live in a specific place on the T.

Now, we have to replace the operations we learned with A, B, and C with the real formulas concerning the part, the total, and the percent (%).

\( \frac{PART}{TOTAL}=PERCENT \)

\( \frac{PART}{PERCENT}=TOTAL \)

\( TOTAL \times PERCENT = PART \)

If you ever have difficulty trying to figure out which number to put where It's usually best to start with the percentage. That's because it is usually pretty straightforward. You're either given a percentage or asked to find a percentage or rate.

It's the next two that might be more difficult, but the total is almost always the larger number and the part is almost always the smaller number. So once you figure out which number should be bigger and which should be smaller those are easy too.

We're going to be using the T Method to solve many problems in the upcoming sections so it will be very helpful for you to memorize the final picture above before moving on.

The T method also helps you if you forget how to calculate any of the items that you'll learn later. Whether it's commissions, appraisals, or interest rates you can easily recognize that you'll be using the T method if you're given two of the three numbers.

Even if you forget how the T works for a specific topic you'll probably get the question right if you just plug the numbers into the T and calculate.

Commissions

Let's face it. You probably don't want to be a real estate agent just to help others buy and sell property entirely out of the goodness of your heart. You probably want to make money too.

Real estate agents make commissions off the sale of property. The commission that is received is based on the selling price of the property and a percentage that was negotiated between the real estate agent and seller when the house was listed.

Because this is how real estate agents get paid, many of them are very interested in (and often excited about) calculating commissions.

So if we're going to start practicing with the T method it's probably the most encouraging to start by seeing how much agents can get paid.

If you know how much money you would make off the next property sale, then you also know how much you can invest in marketing and any other expenses. If it's going to be a small commission then you might not want to spend that much, but if the commission will be big you might want to spend more.

Calculating Commission

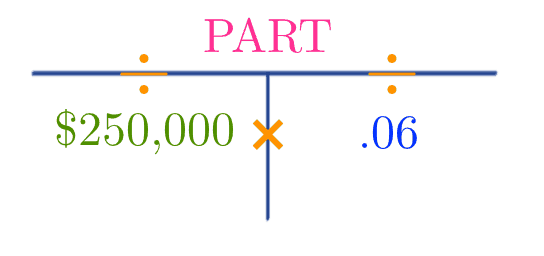

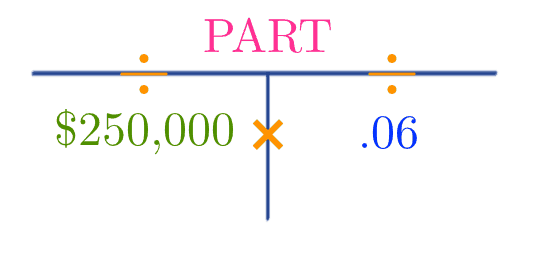

Broker Betty sold a house for $250,000. The owner of the house had agreed to pay Betty a 6% commission. What was the dollar value of Betty's commission?

Let's use the T method to solve this problem.

We're given the total sale price of the home ($250,000), the percentage (6%) and are asked to find the part (the dollar value of the commission). Let's plug this into the T.

Notice that I converted 6% into the decimal .06. That's because it's much easier to enter it into a calculator.

Looking at the T we see that all we have to do to solve this problem is to enter \( $250,000 \times .06 \) into our calculator. When we do that we'll see that Betty's commission was $15,000.

Calculating Commissions Quiz

Broker Bill sold a house for $350,000. The house owner had agreed to pay Bill a 7% commission. What was the dollar value of Bill's commission?

- $50,000

- $12,250

- $24,500

- $122,500

Click for the Answer and Explanation

Answer: $24,500

Explanation: \( $350,000 \times .07 = $24,500 \

Calculating Commission Rate

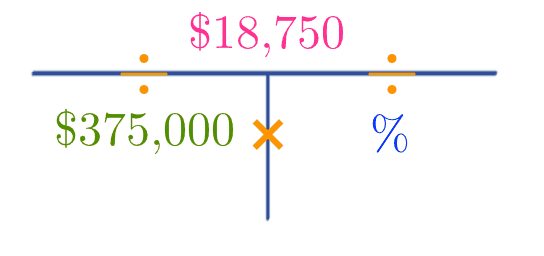

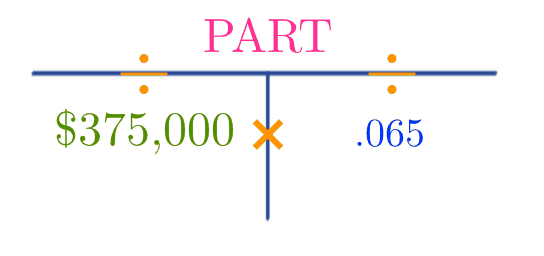

Broker Bill sold a house for $375,000 and received a commission check for $18,750. What was Bill's commission rate for the sale?

Let's use the T method to solve this problem.

We're given the total sale price of the home ($350,000), and the part ($18,750) and we're asked to find the commission rate (percentage).

The T makes it clear that to solve this problem all we have to do is divide $18,750 by $375,000. After putting \( $18,750 \div $375,000 \) into our calculator we get the answer .05, which we then convert to 5%.

Calculating Commission Rate Quiz

Broker Betsy sold a house for $425,000 and received a commission check for $21,250. What was Betsy's commission rate for the sale?

- 5%

- .05%

- 20%

- .20%

Click for the Answer and Explanation

Answer: 5%

Feedback: \( $21,250 \div \$425,000=.05 \)

Finding Sales Price from Commission

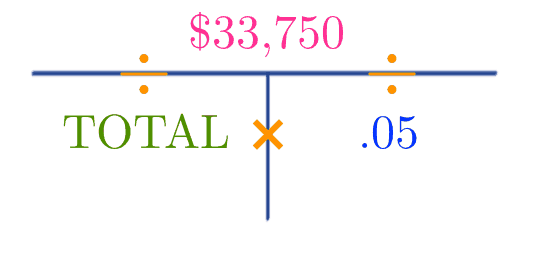

Broker Bob always charges a 5% commission rate for every house that he sells. He sold a house and received a commission of $33,750. What was the selling price of the house?

This problem is very easy to solve using the T method.

We know the percentage (5%) and the part ($33,750). All we need to do is figure out the total selling price.

\( $33,750 \div .05 = $675,000 \)

The house sold for $675,000.

I hope you're starting to see how easy these types of problems are to solve by using the T method.

Finding Sales Price from Commission Quiz

Broker Billy always charges a 6% commission rate for every house that he sells. He sold a house and received a commission of $45,300. What was the selling price of the house?

- $271,800

- $45,300

- $755,000

- $709,700

Click for the Answer and Explanation

Answer: $755,000

Explanation: \( $45,300 \div .06 = $755,000 \)

Commission Splits between Brokers and Salespersons

Here's some bad news. If you're a salesperson you don't get to keep the entire commission. It's split between you and your broker. How it's split is negotiable and varies between brokerages or even within the same brokerage.

So that means you'll know your commission split because that's one of the things you and your broker will agree on before you start working, but I don't know what it will be and the test writers don't know so you'll be asked to solve hypothetical problems.

The good news is that you'll be given all of the information you need in the problem and you can use the T method.

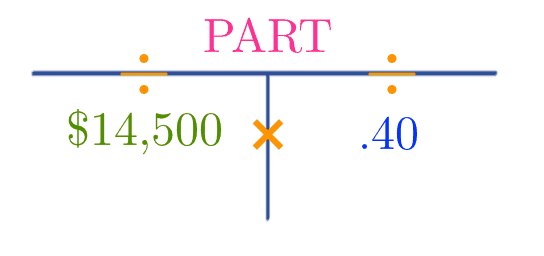

Your brokerage received a $14,500 commission. You have a commission split with your broker and receive 40%. How much commission did you earn?

Let's use the T method to solve this problem.

We're given the total commission earned by the brokerage ($14,500) and the percentage that you'll receive (40%) and are asked to find the part (your commission).

We can see that to solve this, we need to enter \( $14,500 \times .40 \) into our calculator. When we do, we get the answer $5,800, which is your commission.

Commission Splits between Brokers and Salespersons Quiz

Your brokerage received a $28,750 commission. You have a commission split with your broker and receive 50%. How much commission did you earn?

- $14,375

- $28,750

- $5,750

- $143,750

Click for the Answer and Explanation

Answer: $14,375

Explanation: \( $28,750 \times .50 = $14,375 \)

Splitting Commissions between Brokerages

It's rare for a buyer and a seller to both be represented by the same brokerage. Usually the seller is represented by one brokerage and the buyer is represented by another.

The commission split between brokerages is agreed upon in advance. The brokerage that represents the buyer is typically called the "listing" or "seller's" broker, agent, or side and the brokerage that represents the buyer is typically called the "buyer's" broker, agent, or side.

These types of problems can also be solved by the T method.

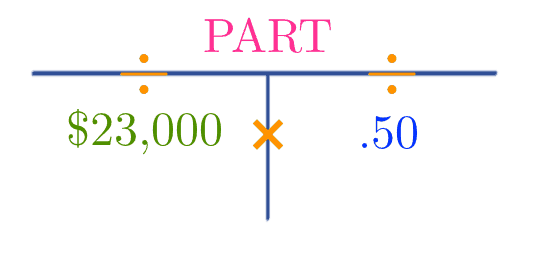

You are a salesperson and receive a 60% split with your brokerage. A house that you listed sold and earned a $23,000 total commission. Your brokerage will share 50% with the buyer's broker. How much commission will you earn?

There's something new about this problem. We actually have to use the T method twice. We'll use it the first time to find your brokerage's commission. The second time we'll use it to find out how much of that commission you'll get to keep.

Many of the math questions on the exam will involve more than one step like this.

We'll use the total commission earned off of the sale ($23,000) and the percentage that your brokerage gets to keep (50%) to find out how much money the brokerage took in.

\( $23,000 \times .50 = $11,500 \)

Your brokerage earned $11,500 off of the sale.

But that's not the answer that the question is looking for. The question asks how much money you'll make as the salesperson. Always pay attention and make sure you answer the right question. Test writers are sneaky and chances are that \( 11,500 \) would be one of the choices if you were asked this question.

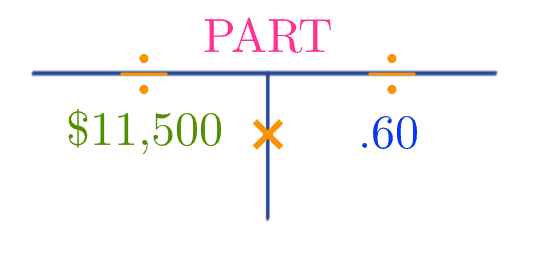

Now we have a new total of $11,500 commission to our brokerage and we just need to figure out how much we get to keep just like in the last topic. Our commission rate is 60% so let's use another T.

\( $11,500 \times .60 = $6,900 \) You earned $6,900 off of the sale. And that's the final answer.

Splitting Commissions between Brokerages Quiz

You are a salesperson and receive a 50% split with your brokerage. A house that you listed sold and earned a $43,000 total commission. Your brokerage will share 50% with the buyer’s broker. How much commission will you earn?

- $21,500

- $43,000

- $86,000

- $10,750

Click for the Answer and Explanation

Answer: $43,000

Explanation: We can solve this in one step by doing both Ts at once. \( $43,000 \times .50 \times .50 = $10,750 \)

Determining Listing Price

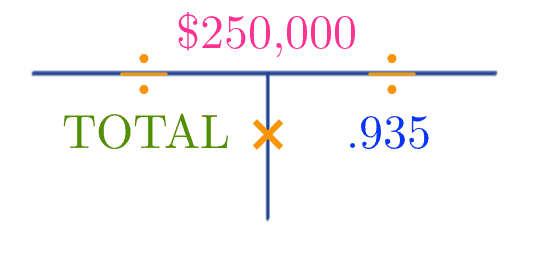

You are about to list a house for sale and the seller has told you that he needs to earn at least $250,000 after paying 6.5% commission. What is the minimum listing price to accomplish this requirement?

At first this looks like a normal T method problem, but it's slightly different. This is one of those places where it can be difficult to immediately recognize the total and the part. The percentage is actually a bit tricky on this one too.

Let's think about what we know so far. Since the seller wants to make at least $250,000 from the sale, after commissions then $250,000 plus some other number is the total. That means that $250,000 is the part.

We know we need to find the total so now we have to figure out the percent. You might want to use 6.5% and then add that to $250,000, but if you did you'd be wrong. That's because $250,000 isn't 6.5% of the total. $250,000 plus a 6.5% commission is the total. So that means that $250,000 is actually 93.5% \( 100-6.5=93.5 \)) of the total. So let's add that to the T.

Now we know how to solve it. \( $250,000 \div .935 = $267,379.679... \). I'll round that up to $267,380 since our client did say he wanted to earn "at least" that much. So $267,380 is the minimum listing price for the client to earn $250,000 and pay a 6.5% commission.

You can also check your work by plugging these numbers back into the T in reverse. Checking your work is always a good idea if you're not sure about an answer and you have time.

If we did our work correctly then that means that \( $267,360-$250,000=$17,360 \) would be our commission. Let's plug that into the T along with the total sales price of $267,360 to see if we get 6.5% back. If we did we know we calculated it correctly. It might also help you believe me that this is how you solve this type of problem.

\( $17,360 \div \$267,380 \) does indeed equal the original commission of 6.5%. Granted there's a small rounding difference, but we know that we caused that ourselves when rounding up earlier.

Determining Listing Price Quiz

You are about to list a house for sale, and the seller has told you that he needs to earn at least $375,000 after paying the total 6% commission. What is the minimum listing price to accomplish this requirement?

- $375,000

- $397,938

- $395,000

- $398,937

Click for the Answer and Explanation

Answer: $398,937

Explanation: \( $375,000 \div (1-.06) = $398,936.17... \) so we'd list at at least $398,937

Advanced Commission Calculations

So far we've been dealing with relatively simple commission splits between brokers and salespersons. Fortunately, but unfortunately, some brokerages can get very creative in how they split commissions. It's fortunate because you'll usually make a more significant commission if you sell more. It's unfortunate because we have to use the T method more than once. There are also some steps before we can even start using the T.

Salesperson Sally works for Broker Betsy who charges a flat 6% commission rate on all of her listings and gives 40% of the total commission to the buyer's broker. Sally earns a 30% commission split on the first $250,000 of sales she brings in for the year and a 50% commission split on any sales over the first $250,000. Sally sold three houses last year. The sales prices were $175,000, $240,000, and $274,000. How much commission did Sally earn last year?

If you think that this problem looks more complicated than what we've seen so far you're right. You might even wonder where to start. To figure it out we look at the problem for clues.

We might be tempted to start at the individual home sales and figure out commissions based upon that, but that won't get us far. The question isn't asking us about individual sales; we're interested in Sally's total commission which is based on her total annual sales so we should start by adding up the three sales.

\( $175,000$240,000+$274,000=$689,000 \)

Sally sold $689,000 in real estate last year. Way to go, Sally!

Now we're getting somewhere. Sally is going to earn a 30% commission from the first $250,000 and 50% on the rest. The rest is \( $689,000-$250,000=$439,000@ \). Remember, though, that this is money paid is only going to be after Sally's broker gives 40% to the buyer's broker.

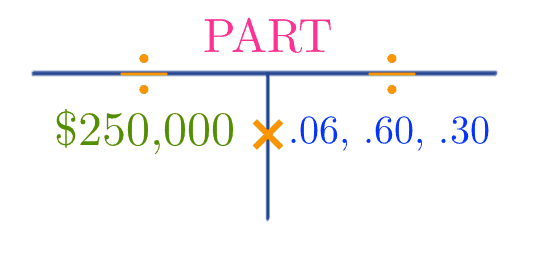

We're finally in the place where we can start using the T. We'll first figure out the broker's commission on the first $250,000 and then calculate Sally's portion based on her 30% commission. We're basically combining a lot of the steps we've learned so far.

We'll then figure out the broker's commission on the next $439,000 and then calculate Sally's portion based on her 50% commission. We'll then add the two commissions together to see what Sally made for the year.

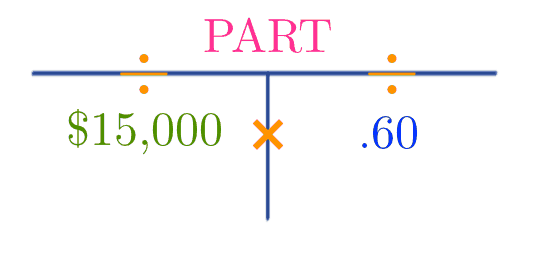

Let's figure out the broker's commission on the first $250,000. We know that the broker charges 6% on all listings.

\( $250,000 \times .06 = $15,000 \). The broker's total commission on the first $250,000 was $15,000. The broker gives 40% to the buyer's broker so that means that 60% stays with Broker Betsy and Sally Salesperson's brokerage. So let's make another T to figure out how much stays in the brokerage.

\( $15,000 \times .60 = $9,000 \)

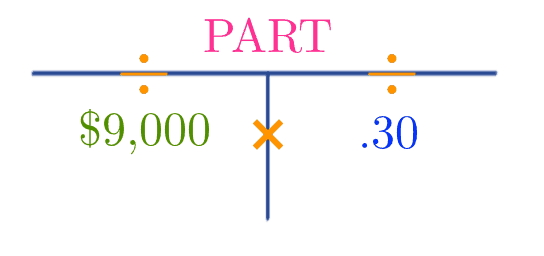

$9,000 stays in Betsy's brokerage. Now we'll figure out how much will go to Sally. Remember that this is the first $250,000, and Sally gets to keep a 30% commission.

\( $9,000 \times .30 = \$2,700 \)

Sally earned $2,700 commission from her first $250,000 in sales last year. But that's only half the problem. We have to do the same thing again to figure out her commission on the rest of her sales.

But before we do that, I want to show you an easier method. We used three Ts, but we could have used one. We used three Ts because we had three percentages, but we could have put all the percentages on the percentage part and multiplied everything together. If we did that, the T would look like this:

The $250,000 is still the total, but we've put all three percentages on the right. They are the brokerage's total commission (6%), what the brokerage keeps after the split (60%) and Sally's portion (30%).

So the new formula is \( $250,000 \times .06 \times .60 \times .30 = $2,700 \). We got the same answer with only one T!

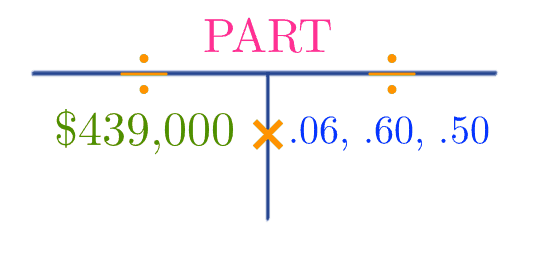

Let's use this shortcut method to calculate Sally's commission on the rest of her sales ($439,000). She earns 50% on these sales. The rest of the numbers stay the same.

\( $439,000 \times .06 \times .60 \times .50 = $7,902 \)

Sally made $7,902 on the rest of her sales for the year. Now we have to add this to her commission on her first $250,000 to get our final answer.

\( $7,902+$2,700=$10,602 \)

Sally earned $10,602 in commissions for the year.

Advanced Commission Calculations Quiz

Salesperson Sally works for Broker Betsy who charges a flat 5% commission rate on all of her listings and gives 40% of the total commission to the buyer’s broker. Sally earns a 30% commission split on the first $300,000 of sales she brings in for the year and a 50% commission split on any sales over the first $300,000. Sally sold three houses last year. The sales prices were $175,000, $195,000, and $274,000. How much commission did Sally earn last year?

- $2,700

- $8,835

- $9,375

- $6,675

Click for the Answer and Explanation

Answer: $2,700

Feedback: Sally's total sales: \( $175,000+$195,000+$375,000=$745,000 \) Sally's sales after the first $300,000: \( $745,000-$300,000=$445,000\) Sally's commission on the first $300,000: \( $300,000 \times .05 \times .60 \times .30 = $2,700 \) Sally's commission on the rest: \( $445,000 \times .05 \times .60 \times .50 = $6,675 \) Add both of sally's commissions: \( $2,700+$6,675=$9,375 \)

Seller's Net

The seller's net (seller's net proceeds) is how much money the seller will receive after subtracting commissions, loan balances, settlement fees, repairs, and any other additional expenses.

It's pretty easy to calculate this. It's the sales price minus all of the expenses. If you see a problem about seller's net you're sure to see the selling price and a list of expenses. The expenses might be in dollar amounts that simply need to be subtracted or percentages that need to be calculated before they are subtracted.

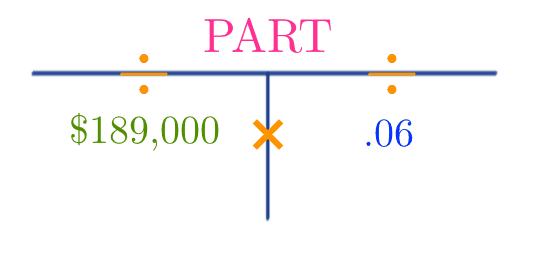

A seller accepts a purchase offer of $189,000. The seller pays her broker a 6% commission, pays off a loan balance of $45,000, and pays various settlement costs that total 3% of the sales price. What are the seller's net proceeds?

There are two percentages here so there are two T calculations. The first is the 6% commission.

\( $189,000 \times .06=$11,340 \)

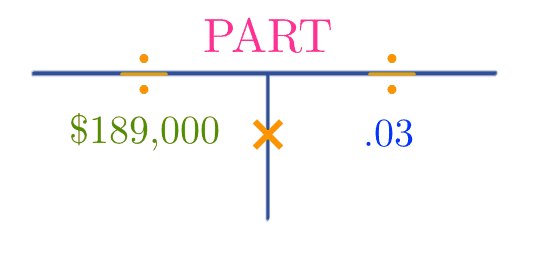

The seller owes $11,340 in commission. Now it's time to calculate the other settlement costs of 3%.

\( $189,000 \times .03 =$5,670 \)

The seller owes $5,670 in other settlement costs.

Now we just subtract the loan balance, commission, and other expenses from the sales price.

\( $189,000-$45,000-$11,340-$5,670=$126,990 \)

The seller's net proceeds are $126,990.

Seller's Net Quiz

A seller accepts a purchase offer of $255,000. The seller pays her broker a 7% commission, pays off a loan balance of $75,000, and pays various settlement costs that total 3% of the sales price. What are the seller’s net proceeds?

- $229,500

- $154,500

- $180,000

- $255,000

Click for the Answer and Explanation

Answer: $154,500

Feedback: \( $255,000-($255,000 \times .07)-($255,000 \times .03)-$75,000=$154,500 \)

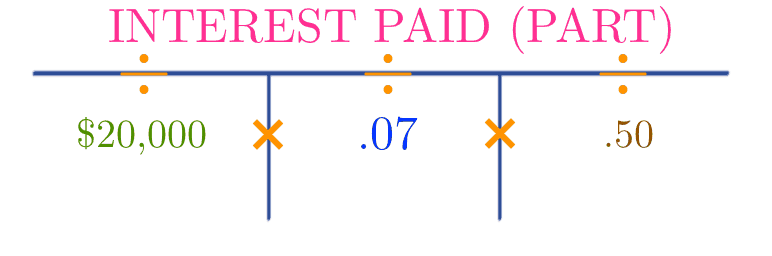

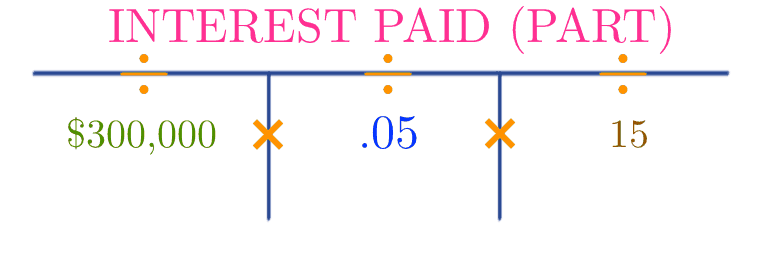

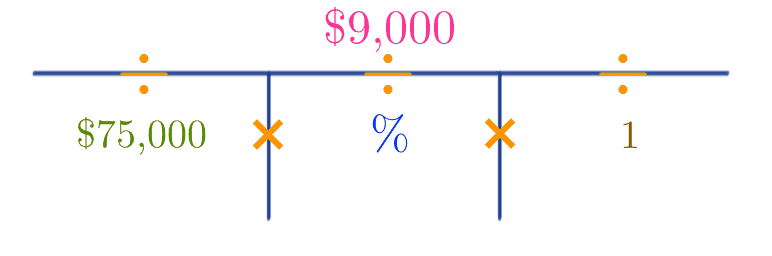

Finance, Mortgages, and Interest

It probably goes without saying that interest rates have a lot to do with real estate because most buyers use mortgages to receive loans.

Interest is the price that is paid to obtain a loan. It is calculated as a fraction (expressed as a percent) of the total amount that was borrowed.

Your customers and clients will definitely have questions about calculating the interest rate and so will the commercial real estate exam.

Luckily we'll be able to use the T method for many of our interest rate calculations. In fact, I think you'll be pleased to see that you already learned how to solve some of these problem types in the previous sections. The main difference is the terms that we are using.

Equity

Equity is the current market value of a property minus the loans on the property. So if a homeowner's home was worth $100,000 on the open market, but the owner had a remaining loan balance of $25,000 on the property then the homeowner would have $75,000 in equity \($100,000-$25,000=$75,000\).

Henry Homeowner still owes $42,300 on the loan for his house. His neighbor just sold the exact same house for $267,000. Assuming that Henry's house can sell for the same price as his neighbors, how much equity does he have?

\( $267,000-$42,300=$224,700 \)

Assuming that Henry's house can sell for the same price as his neighbors, he would have $224,700 in equity.

You may also see equity problems that present percents, totals, or parts. These are simply T problems that you've had lots of experience with so far.

First Year's Amortized Interest

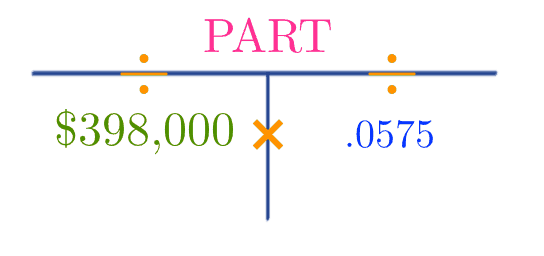

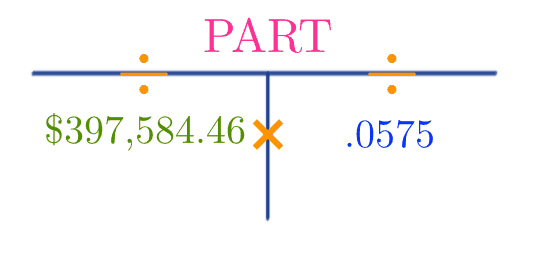

You borrow $375,000 at a 6.5% interest rate for 30 years in an amortized loan. What is the total amount of interest that you will pay during the first year?

When you read this question, you probably noticed an extra piece of information here that we haven't had to use yet, and that's the loan length. Our T method calculations have not yet had a time-based component to them.

We'll have to modify our T chart a bit to add time to our calculations, but we won't need to do so for this problem.

I've said before that test writers can be sneaky. Here, they want to confuse you by thinking you need to use time when you really don't.

But the joke's really on them because I haven't even covered how to include time yet, so we don't know what to do with that anyway. So take that, sneaky test writers!

This is simply a normal T problem because we're only considering the first year. That's because the interest rate is always an annual interest rate quoted each year and is always based on the unpaid balance remaining on the loan.

If we were figuring out the second year we'd have to subtract payments already made to the principal (the original loan amount) for the first year, but that's luckily not the case here.

The total is the principal amount being borrowed of $375,000 and the percentage is the interest rate of 6.5%.

\( $375,000 \times .065 = $23,205 \) You would pay $23,205 in interest the first year of this loan.

First Month's Amortized Interest

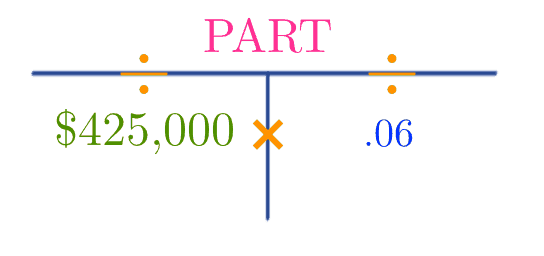

You borrow $425,000 at a 6% interest rate for 30 years in an amortized loan. What is the total amount of interest that you will pay during the first month?

If you think this looks a lot like the problem from the last topic then you're right. All I did was change some of the numbers and ask for the first month's interest.

We'll solve the problem exactly like we solved the last one but we'll divide by 12 to change the annual interest into monthly interest.

Just like we could only do this for the first year in the last topic, we can only do this for the first month with the information that we've been given.

If we wanted to look at future months we'd need to know the monthly payment, which we haven't been given. Also note that the 30 years is there to confuse you again.

The total is the amount borrowed of $425,000 and the percentage is the interest rate of 6%.

\( $425,000 \times .06 = $25,500 \)

You would pay $25,500 in interest in the first year of this loan.

But the question's not asking about the first year; it's asking for the first month, so we have to divide by 12. \( $25,500 \div 12 = $2,125 \).

You would pay $2,125 in interest in the first month.

First Month's Amortized Interest Quiz